Discover the top 5 TradingView alternatives for AI-driven traders in 2026. Compare Orion AI, TrendSpider, Trade Ideas, Tickeron, and QuantConnect with features, pros, cons, pricing, and expert insights to find the best platform for your trading style.

TL;DR

- Compare the top TradingView alternatives for AI-driven and automated trading

- Orion AI is best for research, equity analysis, and workflow automation

- TrendSpider is best for automated technical analysis and alerts

- Trade Ideas and Tickeron are strong in real-time signals and AI pattern recognition

- QuantConnect is ideal for algorithmic and quantitative traders with full code control

TradingView is one of the most widely used charting platforms in the world, but it is not the right solution for every trader. Many traders are now looking for TradingView alternatives that offer AI analysis, automated insights, and smarter workflow management.

This guide compares the best TradingView alternatives, including Orion AI, TrendSpider, Trade Ideas, Tickeron, and QuantConnect. Each platform is evaluated for how well it can replace or complement TradingView in charting, alerts, AI insights, and trader workflows.

Table of Contents

Comparison of Top TradingView Alternatives

| Feature | TradingView | Orion AI | TrendSpider | Trade Ideas | Tickeron | QuantConnect |

|---|---|---|---|---|---|---|

| Charting & Indicators | Full-featured charting with indicators | Limited charting, no full indicator library | Automated technical charting and alerts | Minimal charting, focus on scanning | Basic charting for patterns | No visual charting, code-first |

| AI Market Analysis | None | AI signals via the Holly engine | Partial AI-assisted trend analysis | AI signals via the Holly engine | AI pattern recognition and forecasts | None |

| Backtesting | Manual or via scripts | Partial simulation via Olympus | Code-free backtesting | Simulated trading environment only | Limited | Full code-based backtesting and live testing |

| Alerts & Signals | Manual alerts | Watchlist updates, report alerts, automated inbox notifications | Smart alerts for trends and patterns | Real-time AI scanning alerts | AI-based alerts with confidence scoring | None |

| Best Replacement For | Charting and manual analysis | Research, equity analysis, and workflow automation | Technical traders | Day traders and momentum trading | Pattern-based traders | Advanced daily-updated AI research, scoring, and investment theses |

Best TradingView Alternatives in 2026

1. Orion AI: Best Overall for AI-Driven Traders

Orion AI is a purpose-built AI platform designed for traders, focusing on delivering actionable market insights, equity analysis, and workflow automation, powered by AI work

Unlike traditional charting platforms, Orion AI helps traders save hours of research by generating AI-driven reports, summaries, and trade ideas. Its tools are designed to integrate with charting and execution platforms, making it ideal for professionals, portfolio managers, and AI-focused traders.

Key Features

- AI-generated equity and market analysis

- Natural-language prompts to generate strategies and trade ideas

- Workflow optimization for research and trade preparation

- Integration with charting and execution platforms

- Automated signal summaries and alerts

Who Should Choose Orion AI

- Professional traders seeking AI-guided insights

- Traders who want to streamline research and save time

- Those who rely on detailed AI equity analysis for multiple tickers

- Users integrating AI insights with charting or execution tools

Real-World Example

A portfolio manager can input a watchlist of stocks and use the Equity Analyst feature to spend 10 credits per ticker to generate detailed AI-powered reports. This provides a full view of risk, trend signals, and opportunities in minutes instead of hours.

Pros

- Purpose-built for AI-guided trading decisions

- Reduces manual research workload

- Professional-grade insight quality

- Integrates with charting and execution tools

- Equity Analyst provides per-ticker deep analysis

Cons

- No native backtesting engine

- Not a charting or execution platform

- Higher cost compared to simpler scanners

- Requires companion tools for live execution

- Learning curve for new users

Pricing

Bundle Plans

| Plan | Ticker Coverage | Price |

| Alpha | 100 Orion Analysis tickers + Hermes X Unlimited alerts + 2 Olympus Simulations | $590/month |

| Edge | 200 Orion Analysis tickers + Hermes X Unlimited alerts + 5 Olympus Simulations | $1,190/month |

| Dominion | 400 Orion Analysis tickers Hermes X Unlimited alerts + 10 Olympus Simulations | $2,190/month |

Pay-As-You-Go Credits

- Equity Analyst credits: $1 per credit

- Each ticker uses 10 credits per analysis

Verdict

While Orion AI is not a traditional charting platform like TradingView, it serves as a powerful TradingView alternative for research, analysis, and decision-making workflows. Many traders continue to use TradingView for charts while replacing large parts of their research process with Orion AI’s AI-driven equity analysis and market intelligence.

2. TrendSpider: Best for Automated Technical Analysis

TrendSpider is an AI-driven charting and technical analysis platform designed to automate repetitive tasks like trendline detection, support and resistance identification, and multi-timeframe analysis.

It helps traders save time and improve accuracy by combining automation with AI-powered insights. TrendSpider is ideal for technical traders who want smarter charts and faster alerts without manually scanning markets.

Key Features

- Automated trendlines, support, and resistance detection

- Multi-timeframe AI-assisted analysis

- Code-free backtesting and forward-testing

- Smart alerts for patterns, conditions, and trend changes

- Strategy automation tools

Who Should Choose TrendSpider

- Technical traders who want to reduce manual charting work

- Swing traders looking for automated alerts and signals

- Traders who prefer no-code AI assistance for strategy building

- Users seeking faster, AI-assisted multi-timeframe analysis

Real-World Example

A swing trader sets up TrendSpider alerts to detect breakouts and trend reversals across multiple timeframes. The AI automatically updates trendlines and support/resistance levels, allowing the trader to act quickly without monitoring charts manually all day.

Pros

- Strong automation for technical analysis

- Code-free backtesting makes it beginner-friendly

- Flexible alerts and notifications

- AI strategy assistant for smarter decision-making

- Integration with brokerage accounts for easier execution

Cons

- Learning curve for beginners new to AI charting

- The interface can feel busy for some users

- Higher-tier pricing is expensive

- Less focus on real-time AI signals compared to Trade Ideas

Limited execution capabilities on the platform itself

Pricing

| Plan | Price |

| Standard | $52–$82/month |

| Premium | $61–$149/month |

| Enhanced | $122–$199/month |

14-day free trial available

Verdict

TrendSpider is ideal for traders who prioritize automated charting, alerts, and AI-assisted analysis.

It saves time, reduces manual errors, and allows traders to focus on strategy execution instead of chart maintenance.

While it does not provide predictive trade signals or in-depth equity analysis like Orion AI, it is perfect for technical traders looking to automate and enhance their charting workflow.

3. Trade Ideas: Best for AI Scanning and Real-Time Signals

Trade Ideas is an AI-powered market scanning platform built for active traders who rely on real-time data and fast decision-making.

Its proprietary AI engine, Holly, continuously analyzes market conditions to surface high-probability trade setups during live market hours. Trade Ideas is best suited for day traders and momentum traders who want actionable signals rather than deep research or long-term analysis.

Key Features

- AI-powered market scanner with real-time alerts

- Holly AI engine for strategy generation and signal validation

- Pre-built and customizable trading strategies

- Simulated trading environment for practice

- Real-time data feeds for U.S. equities

Who Should Choose Trade Ideas

- Day traders and momentum traders

- Traders who need real-time AI trade signals

- Users who want automated scanning instead of manual filtering

- Traders focused on short-term opportunities

Real-World Example

A day trader uses Trade Ideas during market hours to identify unusual volume and volatility breakouts. Holly AI filters thousands of stocks in real time and highlights only the setups that match historically profitable patterns, allowing the trader to act quickly.

Pros

- Strong real-time AI scanning and alerts

- Proven AI engine with rule-based transparency

- Excellent for short-term trading strategies

- Built-in paper trading for testing ideas

- Fast and reliable market data

Cons

- Expensive compared to charting tools

- Steep learning curve for new traders

- Limited use outside U.S. equities

- Interface feels dated to some users

- Not designed for long-term investment research

Pricing

| Plan | Price |

| Standard | $118/month |

| Premium (Holly AI) | $228/month |

Discounts available with annual billing

Verdict

Trade Ideas is one of the strongest platforms for real-time AI trade discovery.

It excels at scanning markets and generating short-term opportunities but lacks deep research tools or workflow automation.

Traders focused on speed and signal-driven trading will find Trade Ideas highly effective, while long-term or research-focused traders may prefer tools like Orion AI.

4. Tickeron: Best for AI Pattern Recognition

Tickeron is an AI-powered trading and investment platform focused on pattern recognition, predictive analytics, and AI-generated forecasts.

It uses machine learning models to identify chart patterns, trends, and probability-based outcomes across multiple asset classes. Tickeron is best suited for traders who want AI-assisted pattern discovery and model-driven insights without building strategies from scratch.

Key Features

- AI-powered chart pattern recognition

- Predictive analytics with probability-based forecasts

- AI trading bots and virtual agents

- Multi-asset coverage including stocks, ETFs, crypto, and forex

- Risk and confidence scoring for AI signals

Who Should Choose Tickeron

- Traders who rely heavily on technical patterns

- Intermediate traders seeking AI-confirmed setups

- Users who want probability-based trade insights

- Traders who prefer guided AI signals over manual analysis

Real-World Example

A swing trader uses Tickeron to identify bullish continuation patterns in large-cap stocks. The platform assigns confidence scores to each pattern, helping the trader prioritize setups with higher historical success rates.

Pros

- Strong AI-driven pattern recognition

- Confidence scoring improves decision-making

- Covers multiple asset classes

- Beginner-friendly compared to quant platforms

- Frequent AI model updates

Cons

- The interface can feel cluttered

- AI signals may lack context without manual confirmation

- Limited customization compared to coding platforms

Some features are locked behind higher tiers - Less suitable for professional portfolio analysis

Pricing

| Plan | Price |

| Free | Limited access |

| Premium | $60–$200/month |

Pricing varies based on AI tools and asset coverage

Verdict

Tickeron is a solid choice for traders who want AI-powered pattern recognition and probability-based signals.

It works well as a confirmation tool but is less effective as a standalone platform for advanced traders. Compared to Orion AI, Tickeron focuses more on signal generation, while Orion AI emphasizes research depth and workflow efficiency.

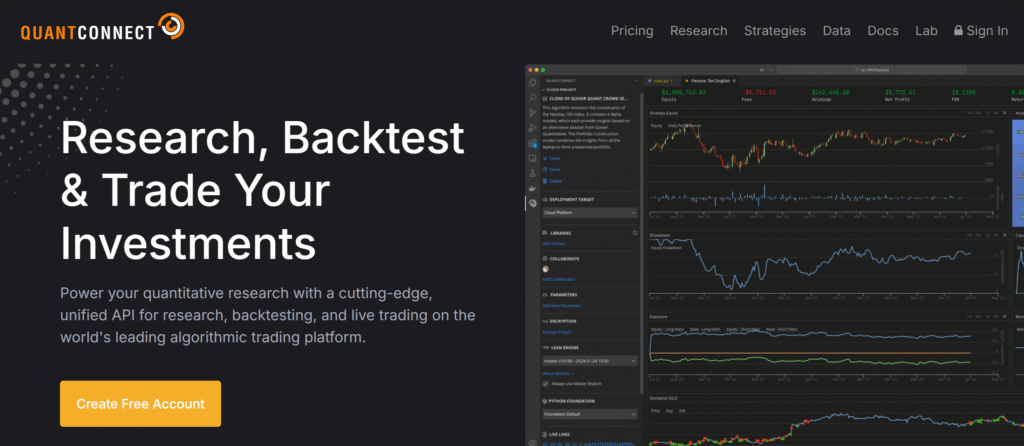

5. QuantConnect: Best for Algorithmic and Quant Traders

QuantConnect is a cloud-based algorithmic trading platform designed for developers and quantitative traders who want full control over strategy creation, testing, and deployment.

Unlike other TradingView alternatives on this list, QuantConnect is code-first and focuses on data-driven, systematic trading rather than visual charting or AI summaries. It is best suited for advanced traders who are comfortable working with code and quantitative models.

Key Features

- Algorithmic strategy development using Python and C#

- Large historical market data library across multiple asset classes

- Built-in backtesting and paper trading environment

- Live trading integration with multiple brokerages

- Open-source community and shared strategy marketplace

Who Should Choose QuantConnect

- Quantitative traders and developers

- Traders building fully automated strategies

- Users who need extensive historical data

- Traders are comfortable coding and managing infrastructure

Real-World Example

A quantitative trader builds a factor-based equity strategy using QuantConnect’s historical data and backtesting engine. After refining the model through simulations, the strategy is deployed live through a supported brokerage with minimal manual intervention.

Pros

- Full control over strategy logic and execution

- Powerful backtesting and live deployment

- Extensive historical and alternative data access

- Strong developer and community ecosystem

- Supports multi-asset strategies

Cons

- Steep learning curve for non-technical users

- No visual charting like TradingView

- Requires coding knowledge to unlock full value

- UI is functional rather than user-friendly

- Not designed for discretionary traders

Pricing

| Plan | Price |

| Free | Limited compute and data |

| Paid Plans | $8–$50+ per month |

Costs increase with data usage and compute resources

Verdict

QuantConnect is the best choice for serious algorithmic and quantitative traders who want complete control over strategy development and execution.

It is not ideal for discretionary or beginner traders, but for those building systematic trading models, it offers unmatched flexibility. Compared to Orion AI, QuantConnect focuses on execution and automation, while Orion AI excels at AI-driven analysis and research workflows.

FAQ’s

What are the best TradingView alternatives for AI-driven traders?

Does TradingView offer AI-driven trading insights?

Is Orion AI a charting or trading execution platform?

Can traders use more than one platform together?

Elevate Your Trading with AI Insights: Final Thoughts

AI-driven trading platforms are changing the way traders approach the markets. From automated charting and real-time alerts to pattern recognition and algorithmic strategies, these tools give traders a powerful advantage. Choosing the right platform depends on your style, goals, and level of experience.

Among the options, Orion AI stands out for its ability to combine deep equity analysis with workflow automation, helping traders save time and make more informed decisions. Unlike traditional charting or signal tools, Orion AI focuses on delivering actionable insights that integrate seamlessly into your trading process.

Take your trading to the next level and experience the difference Orion AI can make.

Start exploring Orion AI today and see how AI-driven research can transform the way you trade..