Table of Contents

Key Takeaways

- Applied Materials (AMAT) is the leading wafer fab equipment provider and is well-positioned for AI chip demand and the HBM upcycle, with strong fundamentals and institutional support

- Alphabet (GOOGL) is a top AI platform and cloud provider benefiting from Gemini AI, broad revenue streams, and strategic partnerships

- Advanced Micro Devices (AMD) is rapidly gaining ground in AI accelerators, data center chips, and strategic collaborations with strong growth momentum

- The report highlights these top picks as the most actionable opportunities for investors seeking exposure to AI infrastructure growth

The AI infrastructure buildout is currently one of the largest capital investment cycles in history, with projections indicating a $6.7 trillion investment required for data centers, power generation, and transmission by 2030. This buildout, often referred to as “the largest infrastructure buildout in human history” by Nvidia CEO Jensen Huang, is rapidly expanding across chips, data centers, and power grids.

Why This Theme Stock Report

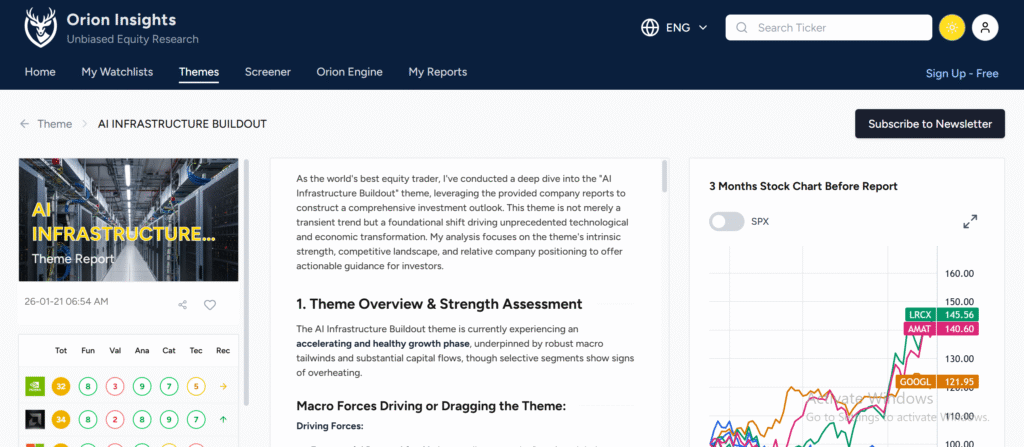

As the world’s best equity trader, I’ve conducted a deep dive into the “AI Infrastructure Buildout” theme, leveraging the provided company reports to construct a comprehensive investment outlook. This theme is not merely a transient trend but a foundational shift driving unprecedented technological and economic transformation. My analysis focuses on the theme’s intrinsic strength, competitive landscape, and relative company positioning to offer actionable guidance for investors.

The AI Infrastructure Buildout is more than a trend. It represents a fundamental shift in technology and the global economy. Advanced computing, data centers, and cloud platforms are driving unprecedented growth and investment.

The goal is to provide investors with actionable insight. It highlights where value is being created, which companies hold durable advantages, and how to navigate the risks and opportunities in this transformative market.

Theme Overview and Strength Assessment

The AI Infrastructure Buildout theme is in an accelerating growth phase. Companies across industries are investing heavily in the hardware, software, and cloud systems needed to power AI. While the market shows strong momentum, some segments are beginning to show signs of overheating.

Driving Forces Behind the Theme

AI infrastructure growth is being fueled by rising demand for compute, data centers, and advanced chips as AI adoption accelerates. Cloud providers and enterprises are increasing long-term spending to support training and deployment at scale. This creates durable opportunities across the AI infrastructure stack.

Exponential Demand for AI

Cloud Computing Expansion

Semiconductor Cycle Momentum

Technological Innovation

Dragging Forces

This theme also faces meaningful headwinds that can slow near-term momentum. Capital intensity, execution risks, and market volatility may affect returns even as long-term fundamentals remain strong.

Geopolitical Risks

High Capital Expenditures

Regulatory Scrutiny

IT Spending Slowdowns

Theme Momentum and Fundamentals

The AI Infrastructure Buildout theme is firmly in a growth phase. Companies report record revenues driven by AI, are expanding capacity, and project multi-year growth. Hypergrowth in cloud and AI segments, along with robust WFE spending, suggests this expansion is sustainable rather than temporary.

Key fundamentals are strong. Revenue growth, margin expansion, and operating profits are solid across major players. Institutional investors are actively accumulating stakes in companies like Microsoft and Applied Materials, signaling confidence in long-term potential.

Catalysts for Continued Growth

New product launches, strategic partnerships, and global adoption of AI continue to drive momentum. While some valuations are high, the underlying strength of this theme indicates continued opportunities for investors who focus on leadership, fundamentals, and disciplined stock selection.

Free AI Infrastructure Buildout Theme Stock Report: My Top Picks

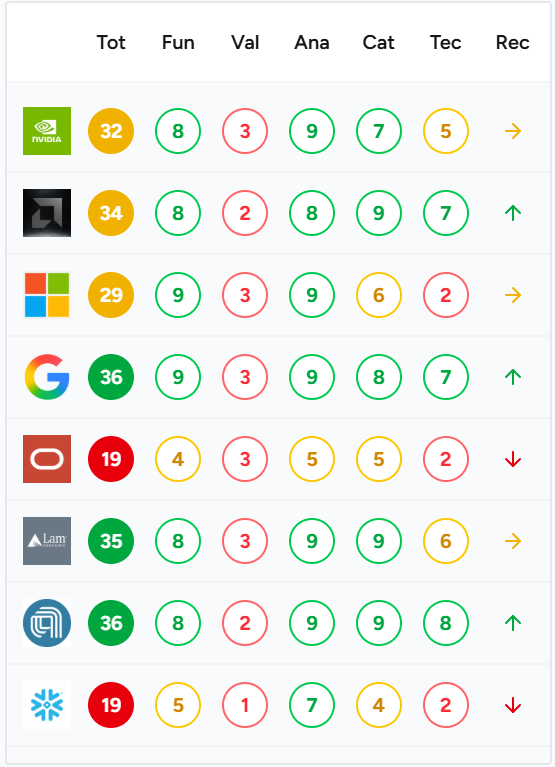

After analyzing fundamentals, market position, valuation, and catalysts, here are the top companies leading the AI Infrastructure Buildout theme. These picks are based on long-term growth potential, strategic advantage, and investor interest.

My Preferred Stocks: Top Picks

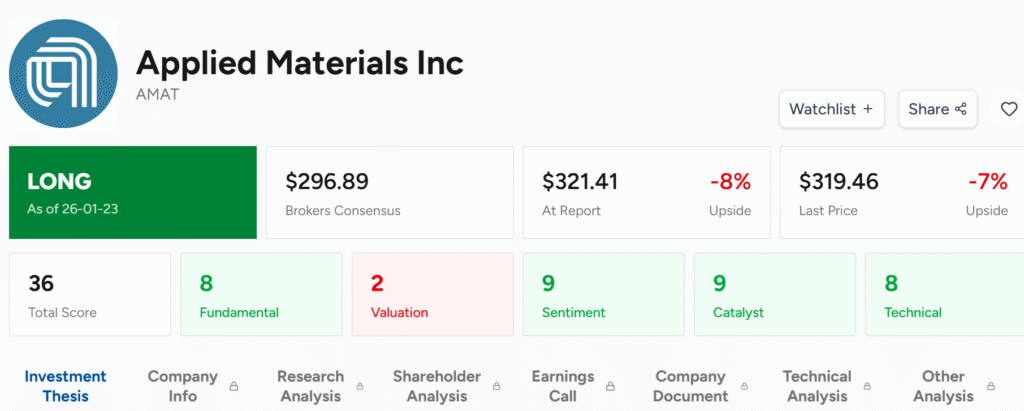

Applied Materials Inc (AMAT)

AMAT is a high-conviction long pick. The company is positioned to benefit from the anticipated wafer fab equipment upcycle in the second half of 2026, driven by AI, high-bandwidth memory (HBM), and advanced chip manufacturing.

Revenue and EPS are strong, and AMAT holds a leadership position in deposition and etch processes, making it a critical enabler of AI infrastructure. While valuations are stretched and technicals show short-term overbought conditions, any pullback can be seen as an opportunity to buy within a solid uptrend.

Alphabet Inc (GOOGL)

Alphabet is a compelling long-term opportunity thanks to its leadership in AI through Google Cloud and Gemini. Q3 results were exceptional, with strong revenue growth across Search, YouTube, and Google Cloud.

Strategic partnerships, including the collaboration with Apple AI, further solidify Alphabet’s ecosystem. Although the stock trades at a high valuation and may consolidate in the short term, its fundamentals and transformative AI initiatives make it a core holding for investors.

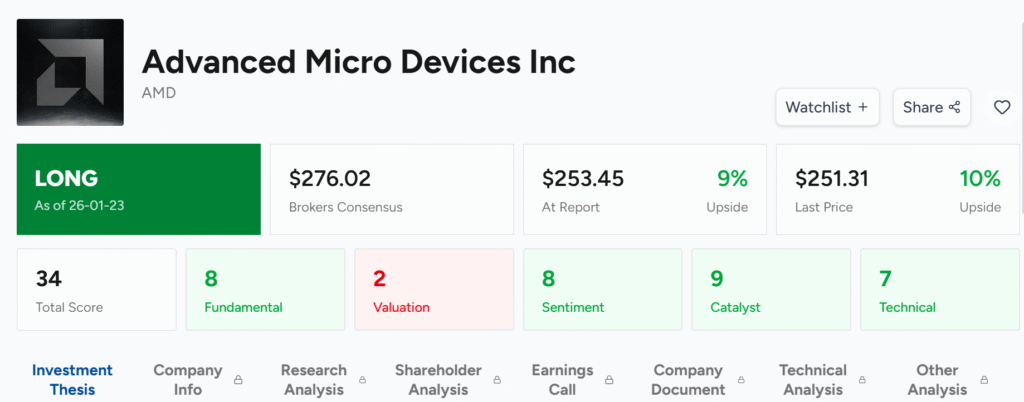

Advanced Micro Devices Inc (AMD)

AMD demonstrates strong momentum in AI and data center markets. Its EPYC and Instinct processors, along with new AI innovations like Helios and MI400X, position the company as a key AI enabler.

Strategic partnerships with OpenAI and Oracle enhance AMD’s growth story. Technicals are overbought, and valuation is high, but pullbacks should be treated as attractive entry points for long-term investors.

Hold-Grade Stocks

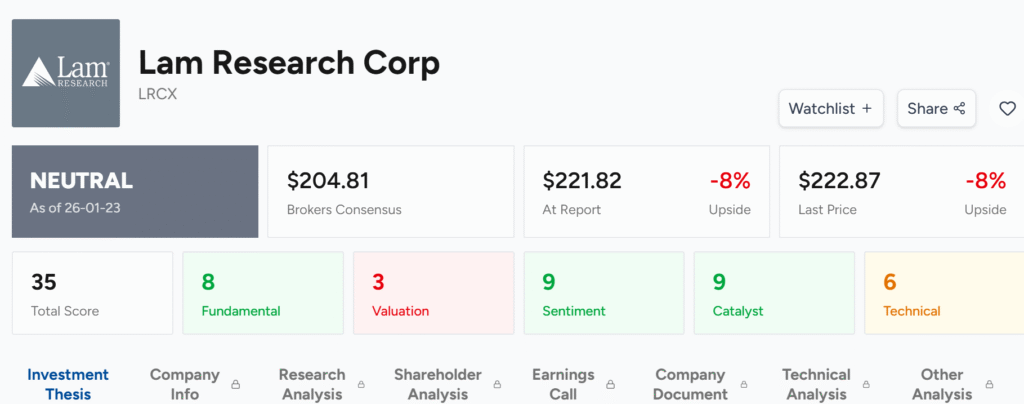

Lam Research Corp (LRCX)

LRCX is a high-quality company with a dominant position in wafer fab equipment. Analyst sentiment is positive, and AI-related demand remains strong.

However, LRCX trades at a premium valuation and is technically overbought. Geopolitical risks, especially from China export controls, also warrant caution. A neutral stance is suggested for the next 1-3 months until potential consolidation occurs.

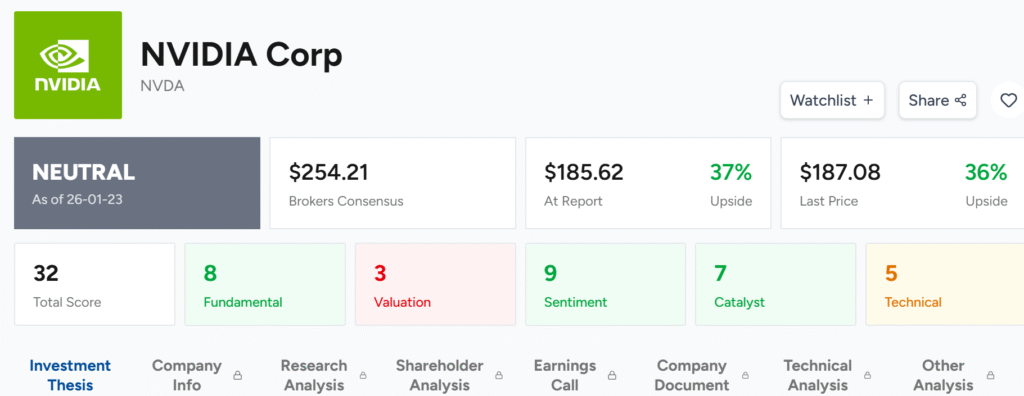

NVIDIA Corp (NVDA)

NVIDIA continues to lead AI hardware and GPUs, with a visionary roadmap including Blackwell and Rubin. Fundamentals are robust, and the company maintains an unassailable market position.

Valuation is high, and geopolitical risks from U.S.-China export restrictions create uncertainty. A neutral stance is recommended until either valuation becomes more attractive or risk factors are resolved.

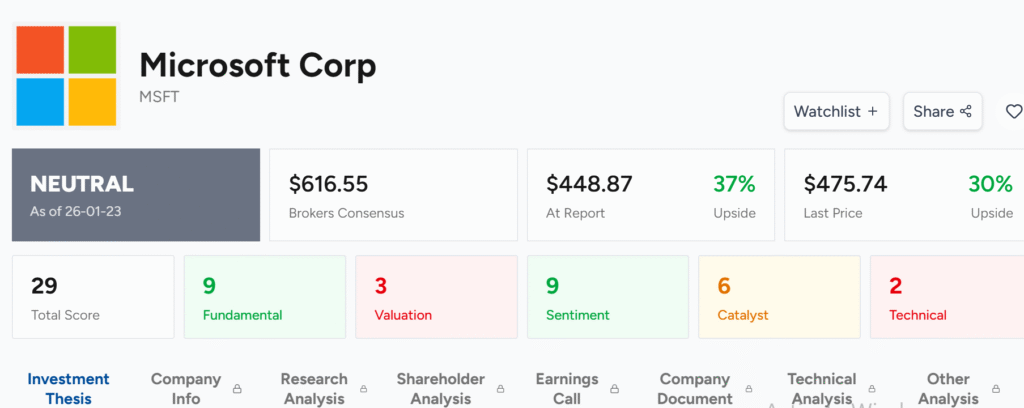

Microsoft Corp (MSFT)

Microsoft is a cloud and AI powerhouse with strong fundamentals and a transformative position in AI services through Azure and Copilot.

Medium-term technical deterioration and regulatory pressures suggest caution for investors seeking short-term gains. A neutral approach is advised while observing stabilization and market sentiment.

High-Risk or Avoid-for-Now Stocks

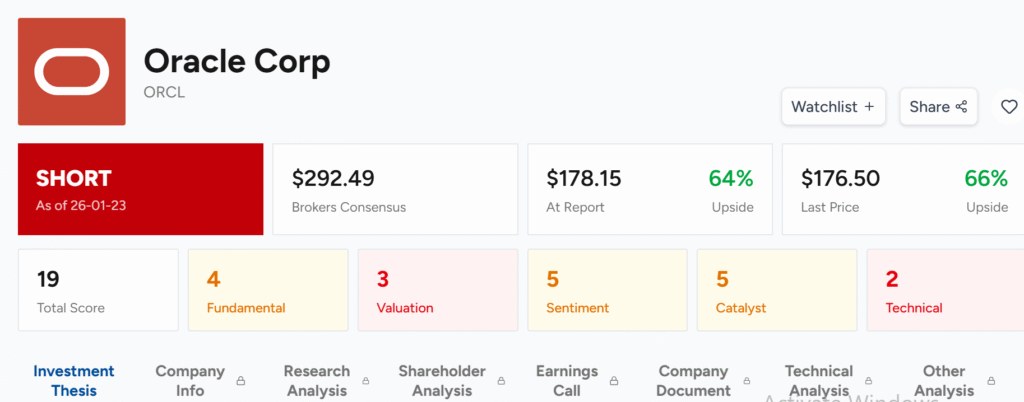

Oracle Corp (ORCL)

Oracle presents financial challenges despite growth in Oracle Cloud Infrastructure and AI. High capital expenditures, negative free cash flow, and ballooning debt create credit risk.

Analysts have lowered targets, and technicals show strong downtrend patterns. This stock is considered high-risk for the current market environment.

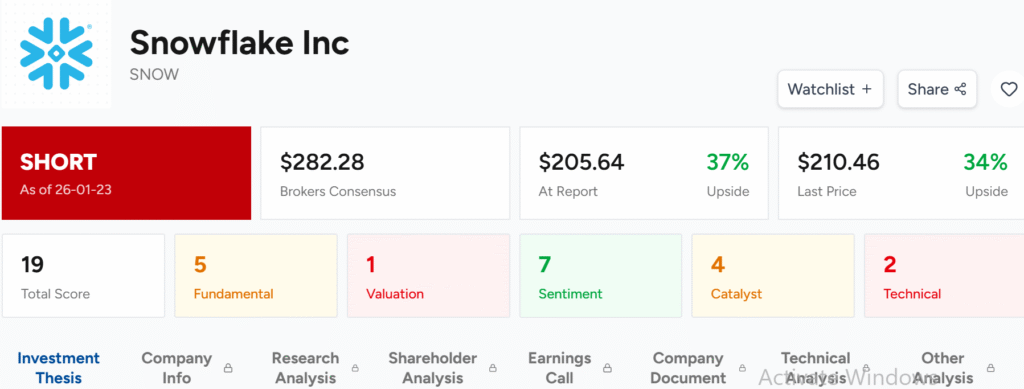

Snowflake Inc (SNOW)

Snowflake faces extreme valuation relative to profitability. While strategically positioned in the AI Data Cloud, GAAP losses, negative cash flow, and insider selling raise concerns.

Technical analysis shows a broad bearish trend, and ongoing legal investigations add to risk. Investors should avoid this stock until conditions improve.

Theme Landscape and Competitive Dynamics

The AI Infrastructure Buildout theme is a complex ecosystem.

Different segments play distinct roles in supporting AI adoption, and each has varying levels of competitiveness and investment appeal. Understanding these segments helps investors identify opportunities and risks.

Key Segments Within the Theme

AI Hardware and Accelerators (Chips and GPUs)

This segment focuses on designing and manufacturing processors that power AI workloads.

Leading Players: NVIDIA holds a clear lead with its full-stack GPU infrastructure, including products like Blackwell and Rubin. AMD is a strong challenger, showing product leadership with EPYC, Ryzen, and Instinct processors and rapid AI innovation.

Semiconductor Manufacturing Equipment (WFE)

This upstream segment provides the tools needed to produce advanced AI chips and memory.

Leading Players: Applied Materials is pivotal in deposition and etch, essential for high-end logic and HBM. Lam Research dominates etch, deposition, and cleaning equipment, enabling advanced chip manufacturing processes.

Cloud Infrastructure and AI Platforms

This segment delivers scalable computing, storage, networking, and AI software services for enterprises.

Leading Players: Microsoft with Azure and Copilot, and Alphabet with Google Cloud and Gemini, are the leaders. Oracle shows strong growth in Oracle Cloud Infrastructure and AI segments.

AI Data Platforms and Analytics

These companies help organizations manage and process vast datasets, which are critical for AI model training and deployment.

Leading Players: Snowflake is strategically positioned in the AI Data Cloud, providing key infrastructure for AI-driven data strategies.

Competitive Pressures and Strategic Trends

Market Leadership and Moats

NVIDIA, Microsoft, and Alphabet demonstrate strong technological leadership and ecosystem lock-in. Their advantages make it difficult for new entrants to challenge them.

New Entrants and Challengers

AMD is rapidly gaining market share in AI accelerators, offering strong product roadmaps and strategic partnerships.

Technology Disruption

The pace of innovation is intense, with new chip architectures and AI models emerging constantly. Continuous research and development are essential to remain competitive.

Strategic Partnerships

Companies are forming alliances to expand AI capabilities. Examples include Microsoft’s collaborations with OpenAI and Anthropic, Alphabet’s deal with Apple, and Oracle’s partnerships with Meta and NVIDIA.

Capital Allocation and Financial Pressures

Massive investment in AI infrastructure, especially data centers and cloud capacity, is impacting financial health. Oracle, for example, projects negative free cash flow due to heavy capital spending.

Regulatory and Geopolitical Risks

Government scrutiny and U.S.-China trade tensions remain critical factors for companies operating in this space.

Most Attractive and Most Challenged Segments

Most Attractive

- Core AI chip design and intellectual property, led by NVIDIA, offers high margins and market leadership.

- Leading-edge semiconductor equipment, provided by AMAT and LRCX, is critical for AI chip production.

- Hyperscale cloud AI services, including Azure and Google Cloud, benefit from enterprise adoption and strong revenue visibility.

Most Challenged

- Companies building massive AI infrastructure, like Oracle, face high capital expenditures and financial strain.

- Data platforms trading at extreme valuations, such as Snowflake, carry profitability risks and investor concern.

FAQs

Which AI infrastructure stocks are currently the strongest?

What makes a stock a top pick in this theme?

Which segments carry the highest risk?

How should investors approach this theme safely?

What factors can cause short-term stock volatility?

What are the key catalysts to watch?

Conclusion

The AI Infrastructure Buildout theme represents a major shift in technology and investment opportunities. Leading chipmakers, cloud platforms, and AI infrastructure companies are building the foundation for the next generation of AI.

Top picks like Applied Materials (AMAT), Alphabet (GOOGL), and Advanced Micro Devices (AMD) combine strong fundamentals, market leadership, and clear growth catalysts. These companies are well-positioned to benefit from the accelerating AI boom.

Risks such as geopolitical tensions, high capital expenditures, regulatory challenges, and valuation pressures remain. A selective approach that focuses on leadership, financial strength, and timing will help investors navigate the theme effectively.

For long-term growth, thematic allocation, or tactical trading, the AI Infrastructure Buildout theme offers strategic opportunities. Staying informed about top picks, key catalysts, and potential risks is key to capturing its transformative value.