The semiconductor supply chain is at the center of one of the biggest technological transformations in decades. AI, digital infrastructure, and geopolitical pressures are forcing the industry to shift from a concentrated, globally integrated system to a more resilient, diversified, and regionalized model.

The opportunity is enormous. The industry is set to grow from around $0.6 trillion in 2024 to over $1 trillion by 2030, driven by AI chips, cloud data centers, and electric vehicles. Past shortages that cost the global economy hundreds of billions have exposed vulnerabilities, pushing companies to invest heavily in new capacity across the U.S., Europe, and Asia, ensuring they are ready for the next wave of demand. These are my highest-conviction stocks across the semiconductor supply chain; not all are buys today, but all are critical to the theme and worth tracking closely.

Table of Contents

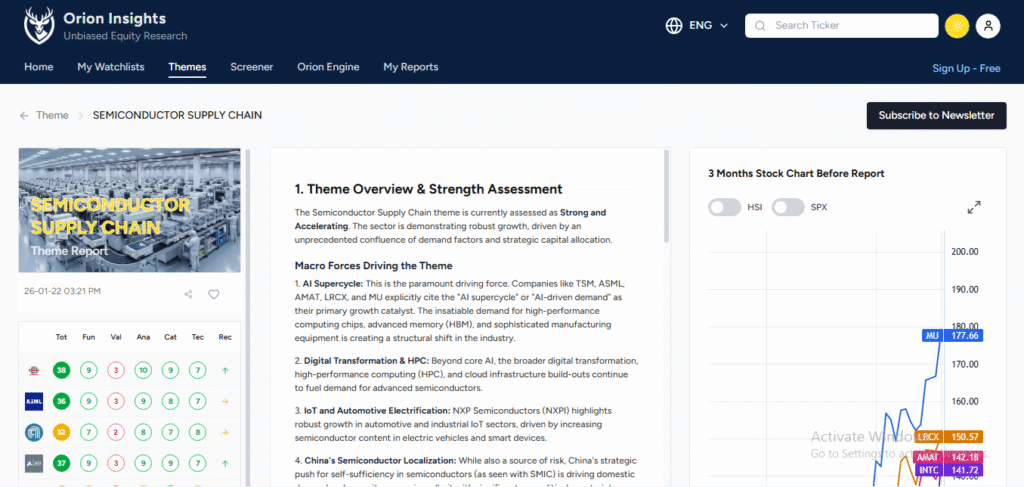

Why This Theme Stock Report

The semiconductor supply chain is evolving faster than ever, driven by AI, digital transformation, and geopolitical pressures. This report is designed to help investors cut through the complexity and focus on the companies best positioned to benefit from these structural shifts.

By highlighting the top 8 stocks, we provide a clear roadmap for those looking to capture the growth potential of AI-driven demand, next-generation manufacturing, and the global push for supply chain resilience. It’s a practical guide for building a high-conviction, theme-focused portfolio in 2026.

Why the Semiconductor Supply Chain Is Heating Up

The industry is in an accelerating growth phase, fueled by structural demand and strategic investments. Key drivers include:

- AI Supercycle: Insatiable demand for high-performance computing chips, High-Bandwidth Memory (HBM), and advanced manufacturing equipment.

- Digital Transformation & HPC: Cloud infrastructure buildouts and high-performance computing projects are driving sustained semiconductor demand.

- IoT & Automotive Electrification: Electric vehicles, smart devices, and industrial IoT systems are increasing semiconductor content.

- China’s Semiconductor Push: Localization efforts and domestic capacity expansions create both opportunities and risks.

Cycle Position: The theme is in an Accelerating phase, with some references to a “semiconductor supercycle” (LRCX) and “memory supercycle” (MU, ASML). Valuations are stretched in parts of the market, but structural AI-driven demand suggests this momentum is likely sustainable.

Top 8 Semiconductor Stocks: My Highest-Conviction Picks

These eight stocks are my highest-conviction picks in the semiconductor supply chain.

They lead in key segments driving AI, memory, and advanced manufacturing, offering strong growth potential and structural advantages.

Top Picks

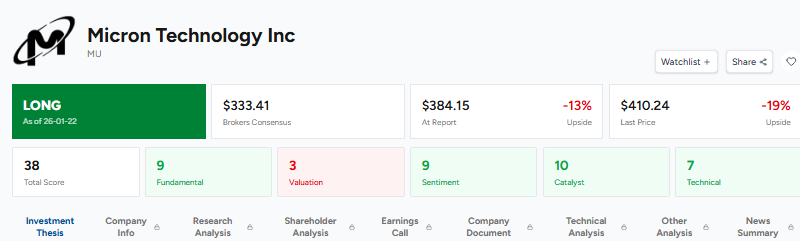

Micron Technology (MU) – Total Score: 41

Micron is a leader in High-Bandwidth Memory (HBM) as well as traditional DRAM and NAND. Its AI memory demand is sold out through 2026, driving strong margins and record earnings growth. The company’s technical uptrend remains strong, and its fundamentals are robust, even considering current overbought conditions.

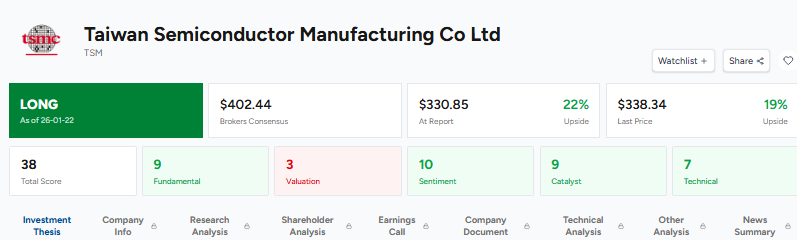

Taiwan Semiconductor Manufacturing Co (TSM) – Total Score: 36

TSM dominates advanced nodes (N3, N2) and CoWoS packaging, making it the primary beneficiary of the AI supercycle. The company has massive capex commitments estimated at $52–$56 billion in 2026, with additional strategic investments from NVIDIA and SoftBank. Strong fundamentals and bullish analyst sentiment reinforce its leadership position.

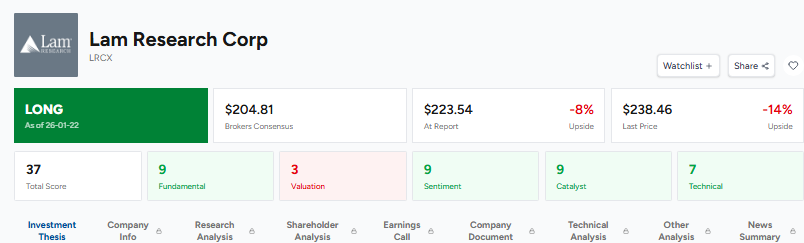

Lam Research (LRCX) – Total Score: 35

Lam Research supplies critical etch and deposition equipment for wafer fabrication and benefits directly from massive customer capex and AI-driven chip production. The company boasts strong fundamentals and accelerating momentum, though technical indicators suggest it is overbought.

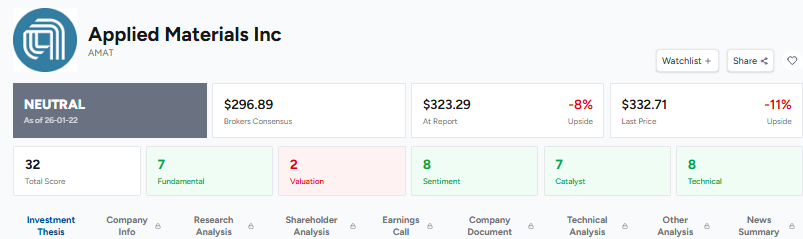

Applied Materials (AMAT) – Total Score: 34

Applied Materials is a leader in GAA, HBM, and advanced packaging technologies. It is well-positioned to benefit from Meta’s $70 billion AI infrastructure investments and other major customer capex. The company shows strong long-term growth prospects, despite a stretched valuation.

Hold

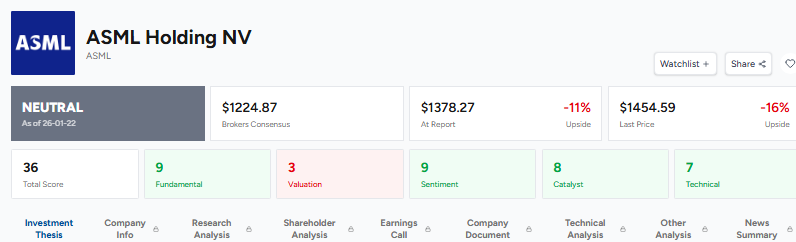

ASML Holding (ASML) – Total Score: 37

ASML holds a near-monopolistic position in EUV lithography. While its fundamentals and long-term catalysts are strong, valuation and technicals are overbought, so a neutral stance is advised.

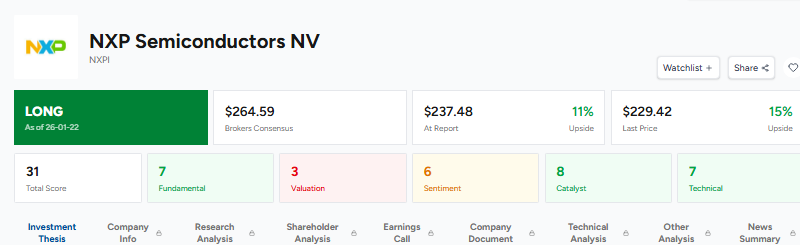

NXP Semiconductors (NXPI) – Total Score: 35

NXP focuses on mixed-signal and specialty semiconductors, with strong growth in automotive and industrial IoT. Strategic acquisitions support its market expansion, but relative valuation and insider activity warrant a cautious hold approach.

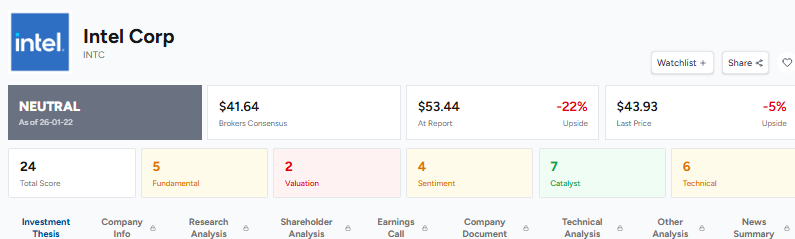

Intel (INTC) – Total Score: 27

Intel is undergoing an operational turnaround with its Foundry Services (IFS) and new 18A process. Catalysts include the Panther Lake launch and external funding, but execution risks and overbought technicals suggest holding rather than aggressive buying.

High Risk / Avoid

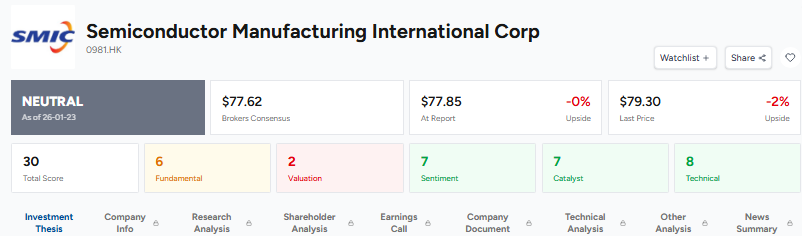

SMIC (0981.HK) – Total Score: 29

SMIC benefits from China’s semiconductor localization drive, but major risks such as US sanctions, restricted access to advanced equipment, and geopolitical uncertainty limit its potential. Fundamentals are weak, valuations are stretched, and the stock is best avoided for now.

Investor Takeaways & Portfolio Strategy

Investors can approach this theme based on risk profile and objectives:

- Long-Term Growth Investors: Focus on top picks (MU, TSM, LRCX, AMAT) for exposure to AI-driven demand and structural growth.

- Tactical Traders: Leverage momentum in MU and LRCX, but manage risk around overbought technicals.

- Thematic Allocators: Diversify across top picks to capture multiple segments of the supply chain, memory, advanced foundries, and wafer fab equipment.

- Value Investors: Fewer opportunities due to high valuations; NXPI may offer dips, while SMIC and Intel turnaround plays remain speculative.

Major Catalysts:

- Accelerating AI adoption

- Next-generation technology inflections (2nm, 18A processes, GAA, HBM4)

- Sustained capital expenditures by TSMC, Meta, and other major customers

- Positive earnings surprises and analyst upgrades

Key Downside Risks:

- Geopolitical escalation (US-China tensions, sanctions)

- Broad market or sector-specific valuation corrections

- Global economic slowdown is impacting demand beyond AI

- Execution risks in scaling new technologies (e.g., Intel Foundry Services)

Timing Considerations:

- Many top stocks are technically overbought; minor pullbacks or consolidation are likely.

- Monitor 50-day moving averages, earnings releases, and geopolitical developments for strategic entry points.

FAQs

Why is the semiconductor supply chain such a hot investment theme right now?

Which stocks are considered the safest bets in this theme?

Are there high-risk opportunities in this sector?

How should investors approach timing in this theme?

Can diversification within the semiconductor theme reduce risk?

Semiconductor Supply Chain Stocks: Final Thoughts

The semiconductor supply chain is at the center of a technological revolution.

AI, cloud computing, and the electrification of industries are driving demand like never before, creating opportunities for investors in key companies that dominate critical parts of the ecosystem.

While the potential rewards are high, investors need to be mindful of stretched valuations, geopolitical tensions, and execution risks for turnaround stories. By focusing on top picks, diversifying across the theme, and staying alert to market signals, investors can position themselves to benefit from one of the most dynamic and transformative sectors of the decade.