Table of Contents

Key Takeaways

- Robotics & Automation is accelerating due to AI, labor shortages, warehouse automation, and defense technology.

- Industrial automation and AI-driven robotics offer the best risk-reward opportunities.

- Healthcare robotics and warehouse automation have long-term growth potential but are also subject to high valuations.

- Selective exposure is critical; not all stocks are buys today.

- ROK is the preferred tactical stock for momentum trades.

- TER and ISRG are suited for long-term growth; AVAV and SYM carry a higher risk.

The global robotics market is set for rapid expansion, projected to grow at a 13.8% to 14% CAGR, reaching $110 to 111 billion by 2030. Robotics and Automation Stocks are gaining attention as AI integration, labor shortages, and demand for autonomous systems drive rapid sector growth. It is no longer a niche technology. It is becoming a core driver of efficiency, productivity, and innovation across multiple industries.

While the opportunity is significant, valuations are elevated for many leading companies. Not every stock in this theme is equally positioned to capitalize on the growth, making selective exposure essential. Investors must focus on companies with strong fundamentals, clear growth catalysts, and sustainable competitive advantages to capture the most compelling returns.

Why This Theme Stock Report

The Robotics & Automation Stocks sector is experiencing rapid expansion, driven by AI adoption, digital transformation, labor shortages, and strategic defense investments. Companies across industrial automation, warehouse robotics, healthcare robotics, and defense technologies are seeing strong structural demand, creating both short-term opportunities and long-term growth potential.

This report identifies the top-performing and most promising stocks within the theme, based on fundamentals, catalysts, valuation, and technical momentum. It equips investors with a clear framework to prioritize high-conviction opportunities, manage risk, and build a theme-focused portfolio that aligns with the accelerating adoption of robotics and AI-driven automation in 2026.

Why Robotics & Automation Is Gaining Momentum

The Robotics and Automation theme is in an accelerating phase, driven by structural demand rather than cyclical recovery. Adoption is expanding across industrial, logistics, healthcare, and defense applications, with AI acting as the primary force multiplier.

Key drivers supporting the theme include:

- AI adoption: AI is transforming automation from rule-based systems into adaptive, decision-driven platforms. This is evident in semiconductor testing at Teradyne, AI-enabled industrial controls at Rockwell Automation, warehouse intelligence at Symbotic, and enterprise IoT at Zebra Technologies.

- Labor Shortages & Productivity Pressure: Persistent workforce constraints across manufacturing, logistics, and healthcare are pushing companies toward automation as a necessity rather than a cost optimization lever.

- Supply Chain Resilience & Onshoring: Companies are investing in automated warehouses, logistics systems, and factory modernization to reduce dependency on labor and improve reliability amid global supply chain reconfiguration.

- Defense & National Security Investment: Rising geopolitical tension is accelerating demand for unmanned systems, counter-UAS technologies, and defense robotics, directly benefiting companies like AeroVironment.

Together, these forces are compressing innovation cycles and expanding adoption beyond early adopters. While long-term growth visibility remains strong, elevated valuations mean opportunity is increasingly concentrated in select names with clear execution, defensible positioning, and identifiable catalysts.

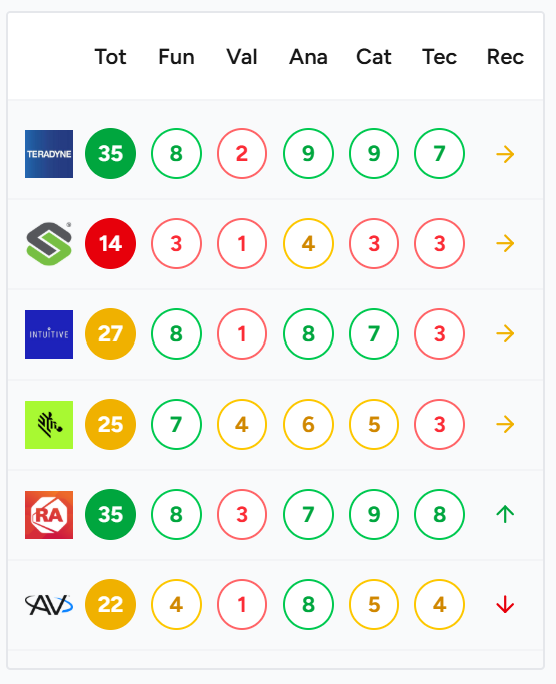

Top Robotics & Automation Stocks

These companies represent the key public market exposures in Robotics & Automation. Rankings consider fundamentals, valuation, momentum, and risk.

Not all are buys today, but each plays a critical role in the theme, highlighting where conviction is highest and where caution is needed.

Top Picks

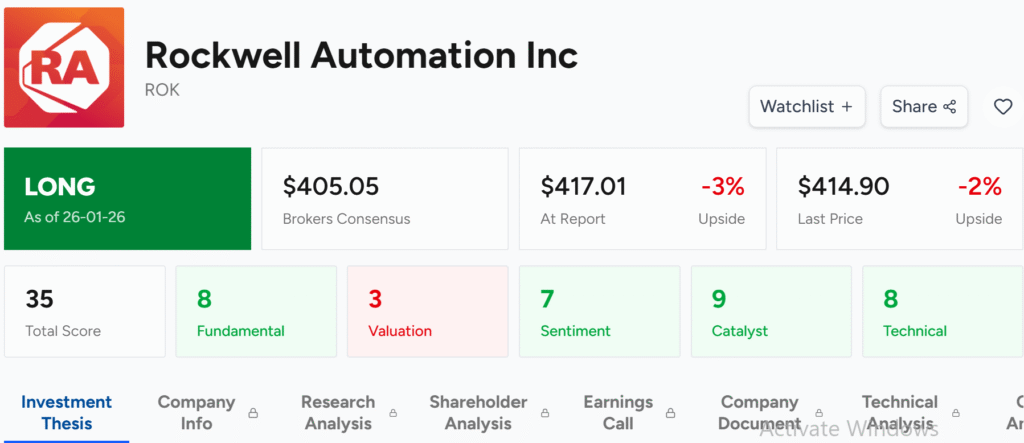

Rockwell Automation Inc (ROK) – Total Score: 35

Rockwell leads in industrial automation and AI-enabled factory solutions. Its software and control segment is growing rapidly, supported by strong manufacturing and logistics demand. Analyst sentiment is bullish, and technical momentum shows a clear uptrend. Despite high valuation, upcoming earnings and new AI-driven products provide near-term catalysts.

Hold-Grade Names

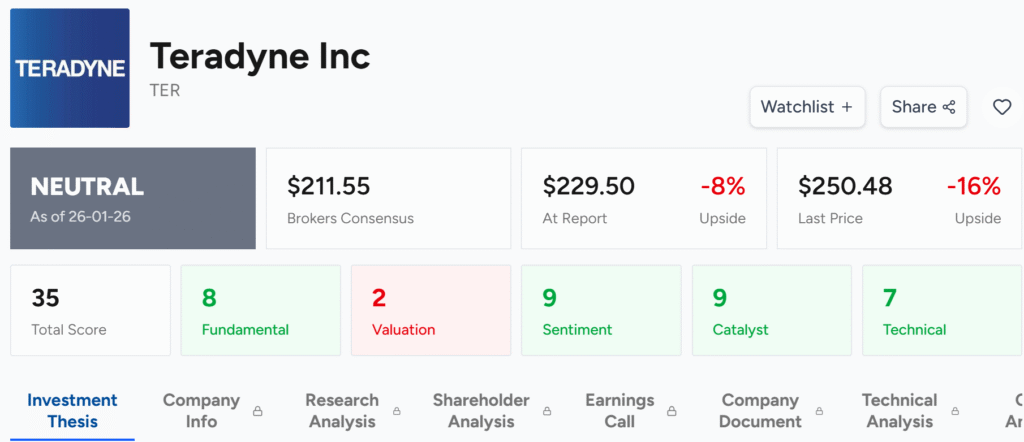

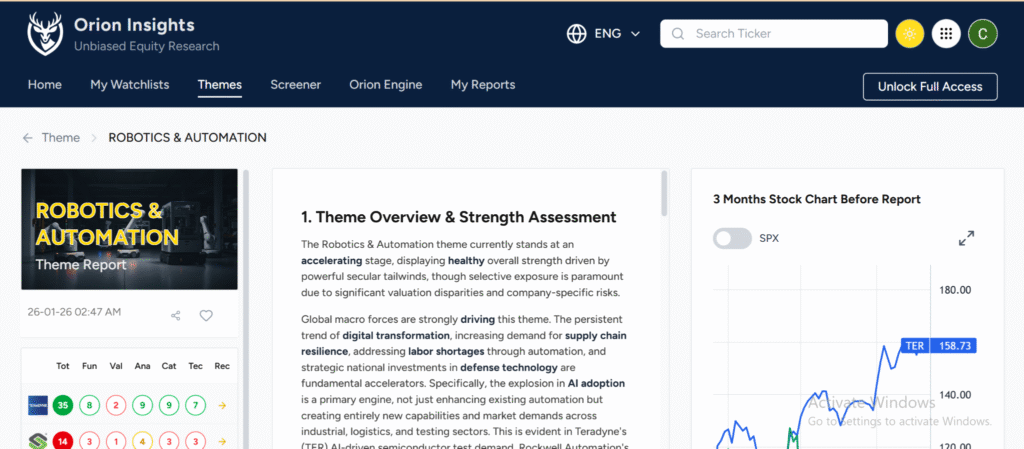

Teradyne Inc (TER) – Total Score: 35

TER dominates semiconductor test equipment and industrial robotics, driven by AI compute demand and HBM growth. Q3/Q4 guidance remains strong, supporting long-term expansion. Valuation is high, suggesting patience for new money; suited for long-term growth investors.

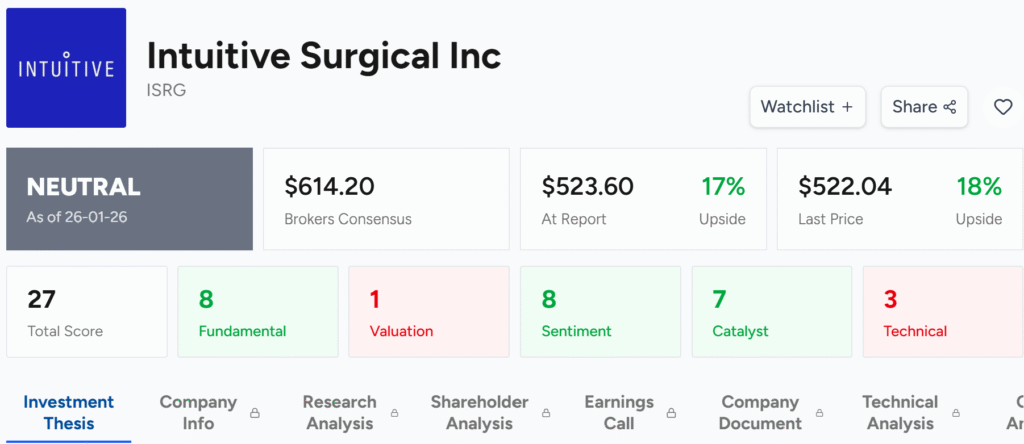

Intuitive Surgical Inc (ISRG) – Total Score: 27

ISRG leads in robotic-assisted surgery, with consistent procedure growth and innovation through dV5 and Ion platforms. Fundamentals are strong, but high valuation and weak technical momentum justify a Neutral/Hold stance.

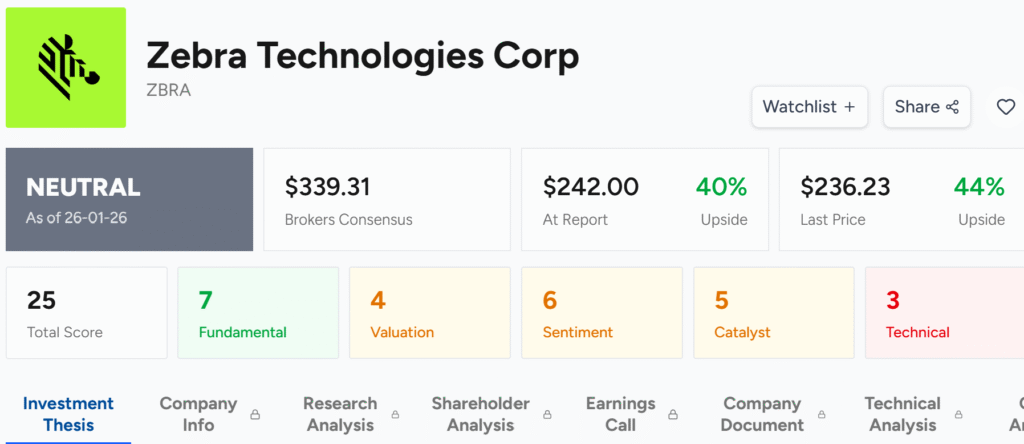

Zebra Technologies Corp (ZBRA) – Total Score: 25

ZBRA provides AI- and IoT-enabled enterprise and warehouse automation solutions. Long-term growth is solid, backed by strategic acquisitions and recurring revenue, but near-term fundamentals are weak, supporting a Neutral/Hold rating.

High-Risk or Avoid-for-Now Names

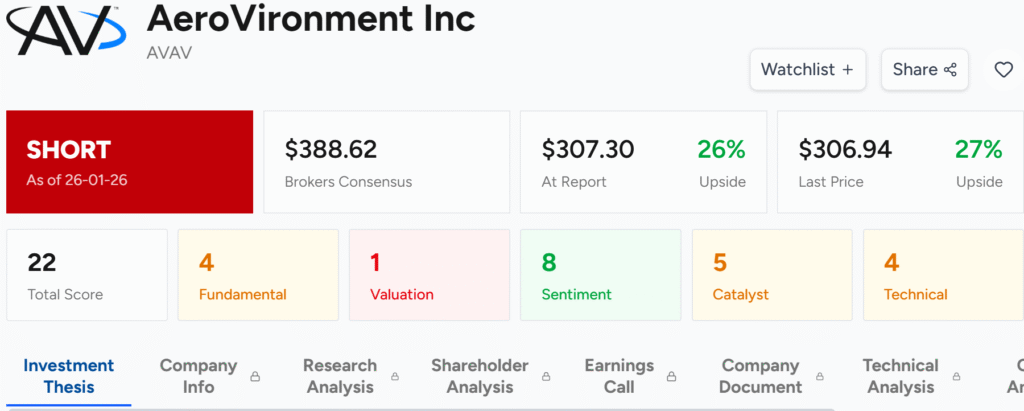

AeroVironment Inc (AVAV) – Total Score: 22

AVAV specializes in UAVs and counter-UAS technology, but contract disruptions, legal investigations, and insider selling create significant short-term risk. High valuation and operational uncertainty make it a medium-term avoid.

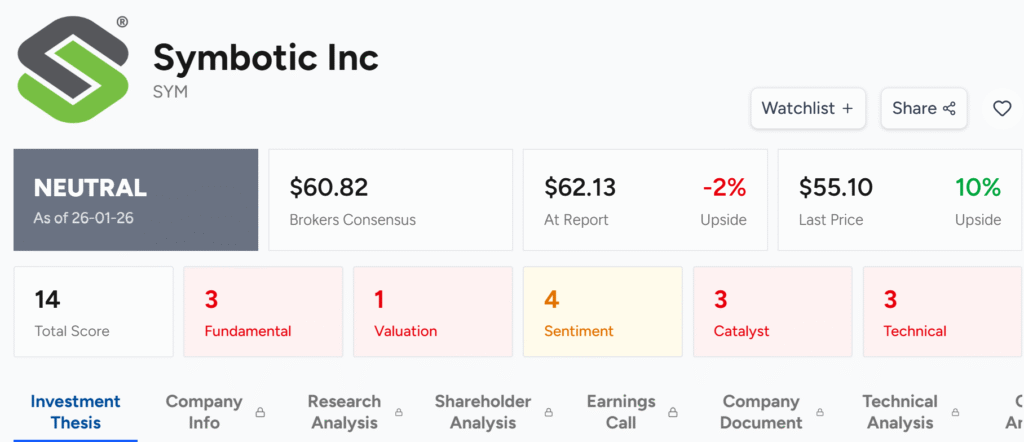

Symbotic Inc (SYM) – Total Score: 14

SYM focuses on AI-powered warehouse automation, but financial restatements, high insider selling, and stretched valuation undermine confidence. The company remains high risk until operational and financial integrity improve.

Investor Takeaways & Portfolio Strategy

Investors can approach this theme based on risk profile and objectives:

- Long-Term Growth Investors: Focus on TER and ISRG for AI and healthcare growth.

- Tactical Traders: ROK for momentum and near-term catalysts.

- Thematic Allocators: Diversify across top picks and segments with clear growth drivers.

- Value Investors: Approach cautiously; most companies trade at premiums.

Major Catalysts

- Accelerated AI adoption in industrial, logistics, and healthcare

- Supply chain reconfiguration and onshoring investments

- New robotics product cycles (ISRG dV5, ROK next-gen controllers)

- Defense modernization and UAV adoption

- Positive earnings from market leaders

Key Downside Risks

- High valuations leaving little margin for error

- Economic slowdown or capex cuts affecting industrial automation

- Execution risks and competition in specialized robotics

- Regulatory hurdles, tariffs, and geopolitical risks

- Rapid technological change outpacing company innovation

Timing Considerations

- TER and ROK are in uptrends but short-term overbought; wait for pullbacks

- Monitor AI adoption, supply chain investments, and defense spending

- Track earnings releases, product launches, and competitive developments

FAQs

What is the Robotics & Automation theme?

Why is this theme accelerating now?

Which stocks are top picks and high-conviction plays?

What are the main catalysts and risks?

How should investors position themselves?

Value approach: Exercise caution; most companies trade at premiums.

Robotics & Automation Stocks: Final Thoughts

Robotics and Automation Stocks are growing rapidly, driven by AI, labor shortages, supply chain needs, and defense investments. Valuations are high, so selective exposure is key.

Rockwell Automation offers short-term momentum, while Teradyne and Intuitive Surgical provide long-term growth. High-risk names like AeroVironment and Symbotic require caution.

A disciplined, theme-focused approach that considers catalysts, technical trends, and valuation will be essential for capturing growth in 2026 and beyond.