Discover affordable AI bookkeeping software options under $50 per month designed for early-stage SaaS startups. Learn how automation saves time, reduces errors, and keeps your financial records accurate and up to date.

Table of Contents

TL;DR

- AI bookkeeping is reshaping how startups manage finances by combining speed, accuracy, and automation.

- The blog reviews seven affordable tools under $50 per month that simplify bookkeeping, reporting, and reconciliation.

- Luca AI leads as a conversational accounting assistant that automates transactions and financial reports in real time.

- Other options like Booke AI, Bookeeping.ai, Puzzle.io, Xero, FreshBooks, and Wave Accounting offer flexible automation for different startup needs.

- Early automation helps founders save time, reduce errors, and stay focused on growth instead of manual accounting.

- The article also shares practical tips for choosing the right AI bookkeeping software and explains how automation strengthens financial decision-making.

Managing finances is one of the biggest challenges for SaaS founders.

Between tracking expenses, logging transactions, and preparing reports, bookkeeping can quickly become overwhelming. Hiring an accountant too early drains funds, while manual spreadsheets often lead to mistakes.

AI bookkeeping software solves this problem by automating financial management. It records transactions, organizes receipts, and generates real-time reports so founders can focus on building products and growing their business.

This blog explores seven reliable AI bookkeeping tools under $50 per month that help startups stay lean, accurate, and financially confident.

Top Affordable AI Bookkeeping Tools for Growing Startups

Finding the right AI bookkeeping tool can make all the difference for growing startups.

The right software saves time, improves accuracy, and keeps your finances organized without breaking your budget. Below are seven affordable options that combine smart automation with simplicity to help you manage your books effortlessly as your business scales.

Luca AI: Your AI Accountant for Effortless Bookkeeping

Price: From 30 credits per month (1 credit = $1)

Luca AI is powered by AI Work, is an intelligent accounting assistant designed to make bookkeeping effortless.

It interprets plain-language messages such as “I paid $30 to GitHub from Bank A” and instantly records them as structured financial entries with linked invoices.

Key Highlights

- Automates bookkeeping, reconciliations, and real-time reporting

- Simple text-based interface for natural data input

- Instant updates with invoice and receipt storage

- Consistent accuracy and 24/7 availability

Best for: Startups, freelancers, and small businesses that prefer conversational, automated accounting without technical complexity.

Booke AI: Automation for Modern Accounting Teams

Price: $20–$50 per month

Booke AI streamlines bookkeeping tasks by automating categorization, reconciliation, and reporting. It delivers fast, accurate results that save founders from tedious manual work.

Key Highlights

- AI-driven transaction categorization and statement generation

- Clean, user-friendly dashboard for insights

- Quick setup requiring minimal training

Best for: Founders who need dependable, automated bookkeeping they can trust to run quietly in the background.

Bookeeping.ai: Smart Financial Automation for SaaS and E-Commerce

Price: $29 per month

Bookeeping.ai offers deep automation capabilities for digital businesses. It integrates directly with Stripe and Shopify, tracking recurring transactions and online sales with up to 95% automation accuracy.

Key Highlights

- Real-time income and expense tracking

- Seamless integrations with major payment platforms

- Clear dashboards for cash flow and revenue visibility

Best for: SaaS and e-commerce startups that rely on recurring payments and need efficient, automated tracking.

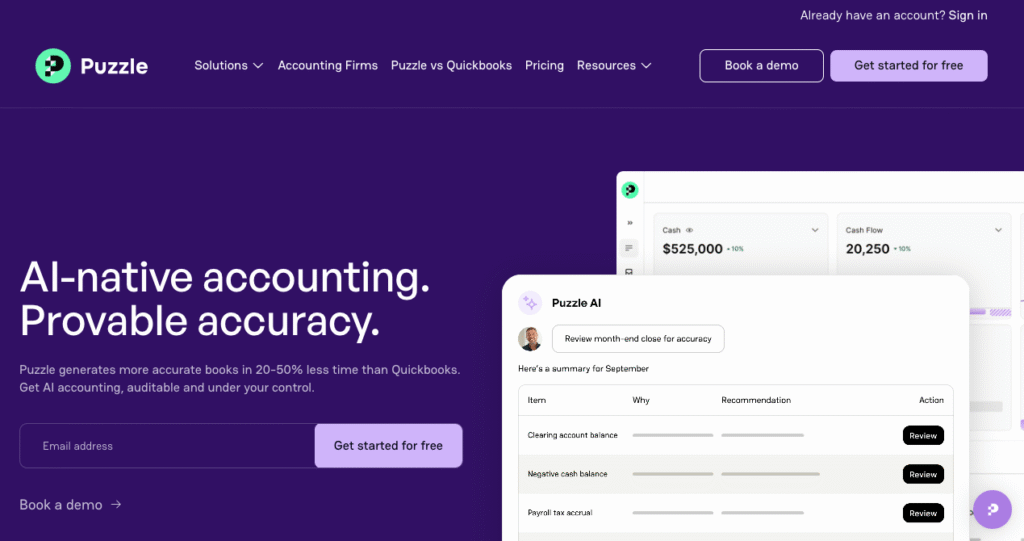

Puzzle.io: Real-Time Insights for Startup Founders

Price: $25 per month

Puzzle.io combines bookkeeping automation with real-time analytics, giving founders instant visibility into company performance.

It tracks cash flow, burn rate, and runway to help leaders make data-driven decisions.

Key Highlights

- Automated transaction management and categorization

- Live dashboards for key financial metrics

- Instant insights for founders and investors

Best for: Data-driven founders who want financial clarity and automated reporting in one platform.

Xero: Reliable Cloud Accounting with AI Efficiency

Price: $29 per month (basic plan)

Xero is one of the most trusted names in online accounting. It automates reconciliation and reporting through bank feed synchronization and offers scalability as startups grow.

Key Highlights

- Automated bank reconciliation and categorized feeds

- Scalable structure for expanding teams

- Detailed reports for compliance and forecasting

Best for: Startups planning long-term growth and needing a professional-grade platform that can scale with them.

FreshBooks: Simple, Affordable Bookkeeping for Starters

Price: $15 per month

FreshBooks is built for simplicity, offering all the essentials for small businesses. It includes invoicing, expense tracking, and time management in a user-friendly interface.

Key Highlights

- Intuitive dashboard for non-accountants

- Automated invoicing and expense capture

- Cloud-based access across devices

Best for: Freelancers and new founders who want to keep finances organized without learning complex systems.

Wave Accounting: Free Bookkeeping for Bootstrapped Founders

Price: Free plan; Pro plan from $16 per month

Wave Accounting delivers essential bookkeeping and invoicing tools at no cost, making it ideal for lean startups. It’s easy to use, setup is fast, and basic automation handles daily financial needs.

Key Highlights

- Free accounting with invoice and receipt tracking

- Simple automation for core bookkeeping tasks

- Easy to navigate for beginners

Best for: Entrepreneurs and early-stage teams working on tight budgets who still want accurate financial tracking.

Comparison Table: AI Bookkeeping Software Under $50 per Month

| Tool | Price | Interface Type | Notable Strength | Ideal For |

| Luca AI | From 30 credits ($30) | Conversational AI | Chat-based automation with instant reporting | SaaS startups, freelancers, small businesses |

| Booke AI | $20–$50 | Cloud Dashboard | Fast automated categorization and reconciliation | Small startup teams |

| Bookeeping.ai | $29 | Web Platform | Deep Stripe and Shopify integration | SaaS and e-commerce startups |

| Puzzle.io | $25 | Analytics Dashboard | Real-time cash flow and performance insights | Data-focused founders |

| Xero | $29 | Cloud Suite | Scalable and compliance-ready accounting | Growing startups |

| FreshBooks | $15 | Simple Dashboard | Easy invoicing and expense tracking | Freelancers and early-stage founders |

| Wave Accounting | Free / $16 Pro | Web App | Free access with essential automation | Bootstrapped entrepreneurs |

How to Choose the Right AI Bookkeeping Tool

The right AI bookkeeping software should align with your startup’s goals, automate financial tasks, and scale as you grow. Choosing the right one becomes much easier when you know exactly what to evaluate.

1. Understand Your Needs

Begin by defining what your business truly requires.

- Do you need simple expense tracking or complete financial reporting?

- Are you focused on automation or deeper insights through AI?

- Clarifying this helps you narrow down the best-fit tools quickly.

2. Check Integration Compatibility

Your bookkeeping platform should work smoothly with your existing systems.

- Look for integrations with your bank, Stripe, PayPal, or Shopify

- Ensure it can pull in data automatically from your payment sources

- The more connected it is, the less manual input you need

3. Assess the Level of Automation

Not every AI tool automates at the same level.

- Choose platforms that categorize, reconcile, and generate reports automatically

- Avoid options that still rely heavily on manual work

- Strong automation saves time and keeps your books error-free

4. Consider Scalability

A good tool should grow alongside your startup.

- Can it manage larger transaction volumes over time?

- Does it support multiple users or currencies?

- Scalable systems prevent the need for costly transitions later

5. Prioritize Ease of Use

Even powerful tools must be simple to navigate.

- Look for clean, intuitive dashboards

- Quick setup and minimal training are key

- The right tool should make your bookkeeping easier, not harder

6. Test Before You Commit

Most AI bookkeeping software offers free trials or demo periods.

- Try out a few to see how automation fits your workflow

- Evaluate accuracy, speed, and user experience

- Choose the one that feels effortless and natural to use

The best bookkeeping software is the one that simplifies your financial workflow, fits your business goals, and scales as your startup grows.

Why Early Automation Matters for Startups

For early-stage startups, time, accuracy, and focus are everything. Every hour spent on bookkeeping is an hour lost from building, selling, or improving your product. Automating early helps founders stay organized, save time, and make smarter decisions from day one.

1. Saves Time and Prevents Mistakes

Manual bookkeeping is slow and error-prone.

- AI handles repetitive work automatically

- Categorizes transactions and reconciles payments in seconds

- Reduces errors caused by manual data entry

2. Keeps Financial Data Up to Date

Automated tools update records instantly after each transaction.

- Always know your cash flow and profit position

- Generate reports anytime without waiting for the month-end

- Make fast, data-driven decisions backed by real-time insights

3. Builds Investor Confidence

Accurate, automated records show discipline and credibility.

- Simplifies tracking of MRR, churn, and burn rate

- Makes investor reporting faster and cleaner

- Helps you stay audit-ready during funding rounds

4. Scales Effortlessly with Growth

As transactions grow, automation scales with you.

- Handles larger data volumes without extra work

- Adapts to multiple accounts, users, or currencies

- Prevents future system overhauls as your business expands

5. Frees Founders to Focus on Strategy

When financial tasks run automatically, you gain time and clarity.

- Focus on product innovation and customer growth

- Make strategic moves without worrying about the books

- Keep your operations lean while maintaining accuracy

Early automation is more than a convenience. It’s a foundation for sustainable growth, giving startups the freedom to innovate while staying financially sharp.

Affordable AI Bookkeeping Software: Final Thoughts

AI bookkeeping is transforming how startups handle their finances. It brings accuracy, speed, and clarity without the cost of a full-time accountant.

For early-stage founders, the right AI tool means spending less time managing numbers and more time driving growth. Platforms like Luca AI, Booke AI, and Puzzle.io make bookkeeping effortless and affordable, while Wave Accounting gives new teams a solid starting point.

Automating early creates a strong financial foundation. It reduces errors, keeps records clean, and gives founders real-time visibility into their financial health. With that clarity, decisions become faster, smarter, and more confident.

Ready to make your accounting smarter? Try Luca AI today to see how it can automate your bookkeeping.