Discover the best AI stock fundamental analysis tools. Explore top AI platforms to evaluate company performance, spot hidden risks, and make smarter investing decisions. Subscribe to our LinkedIn Newsletter for regular updates.

TL;DR

- Traditional stock research is slow and overwhelming. AI makes the process faster, easier, and more reliable.

- These tools scan financial statements, ratios, and market data in seconds, surfacing insights that might take hours to find manually.

- AI goes beyond number-crunching by spotting hidden patterns, forecasting performance, and even analyzing the tone of company updates and earnings calls.

- Risk checks are built in, flagging issues such as rising debt, weak cash flow, or overexposure to certain industries that investors might overlook.

- AI is not about replacing human judgment. It is about giving investors sharper insights, fewer blind spots, and more time to focus on strategy.

- Some of the best AI tools for fundamental stock analysis include Orion AI, Finviz AI, TrendSpider, Kavout, Trade Ideas, and Zacks AI.

Let’s be honest.

Nobody enjoys digging through endless 10-K reports or manually calculating ratios. It is slow, stressful, and easy to miss something important. That is where AI Work comes in. These AI-powered fundamental analysis tools handle the number-crunching and data scanning for you. They highlight key metrics, spot trends, and flag potential risks quickly and accurately.

In short, AI is not just making investing easier; it is making it smarter. Whether you are new to the market or an experienced investor, these tools can help you make decisions with more confidence and less guesswork.

Table of Contents

What Is AI Stock Fundamental Analysis?

At its heart, fundamental analysis is about answering one simple question: Is this company financially strong enough to invest in? Traditionally, investors spend hours sifting through balance sheets, income statements, and cash flow reports, often topping it off by listening to management calls. It is a lot of work and can feel overwhelming, especially if you are just starting out.

The best way to picture it is this:

- Traditional analysis is like trying to read every book in a library, page by page.

- AI fundamental analysis is like having a skilled assistant who scans the entire library in seconds, hands you a clear summary, and even highlights the sections that could spell trouble.

Take a company like Apple as an example. An AI tool could:

- Review a decade of financial statements in moments.

- Compare Apple’s performance against competitors such as Samsung or Microsoft.

- Analyze what the CEO says during earnings calls, picking up on confidence or hesitation in their tone.

- Flag potential risks, whether it is a supply chain disruption or a looming regulatory issue.

- Generate a data-backed forecast of earnings for the upcoming quarter.

Put simply, AI stock fundamental analysis uses artificial intelligence to dig into a company’s financial health and future potential. You, the investor, still make the final decision, but AI makes sure you have sharper insights, faster results, and fewer blind spots along the way.

What Are AI Stock Fundamental Analysis Tools?

AI stock fundamental analysis tools, like those from AI Work, are software platforms designed to help investors quickly understand the financial health of companies. They go beyond simple calculators or spreadsheets by using natural language processing, machine learning, and predictive modeling.

Here’s what these tools can do:

- Read and interpret financial statements: Instead of just showing revenue and expenses, AI can flag whether growth is sustainable or if debt levels are rising too quickly.

- Analyze earnings call transcripts: By examining the tone and word choice of executives, AI can detect confidence or hesitation that might not be obvious on the surface.

- Compare companies with peers: A company may look good in isolation, but AI can show whether its performance is truly outstanding or just average within the industry.

- Generate forecasts: Using years of historical data, AI can project possible revenue or margin growth, giving investors an outlook beyond the current quarter.

For everyday investors, these tools simplify a process that once required hours of manual research or access to expensive institutional reports.

Why Investors Are Turning to AI for Fundamental Analysis

Investors are not just using AI because it is trendy. They are using it because it solves real problems. Traditional research is slow, limited, and prone to human error. AI takes those barriers away and delivers clear, data-driven insights.

Some of the biggest reasons investors are adopting AI include:

- Efficiency: Instead of spending an entire evening reviewing financial reports, investors can get summaries in seconds.

- Consistency: AI applies the same standards to every company, which reduces bias and missed details.

- Accessibility: Tools that were once only available to professional analysts are now available to retail investors at a fraction of the cost.

- Better decision-making: With real-time data, forecasts, and alerts, investors can make decisions with more confidence.

For beginners, AI makes investing less intimidating. For experienced investors, it sharpens their edge by providing a level of depth and speed that manual research cannot match.

Benefits of Using AI in Fundamental Stock Analysis

When most people think of stock research, they picture endless spreadsheets, balance sheets, and quarterly reports.

While these documents are essential, they can also be overwhelming. AI transforms this process by doing the heavy lifting, analyzing the data in seconds, surfacing what matters most, and giving investors a clearer starting point for decision-making.

Let’s look at the key benefits AI brings to fundamental stock analysis.

- Time Saving: Going through earnings reports one by one is exhausting. When you have dozens of companies to track, it can take days just to get a clear picture. That’s where AI Work comes in. Their AI tools can scan and analyze all that data in seconds, so you spend less time buried in reports and more time thinking about your strategy and making confident investment decisions.

- Reduced Human Error: Even the most disciplined analysts make mistakes. Fatigue, distraction, or simply rushing through numbers can lead to costly errors. AI systems, by design, are consistent. They apply the same logic across every data point, reducing the chance of typos, missed calculations, or overlooked footnotes in a financial statement.

- Hidden Insights You Might Miss: AI does not just process numbers; it interprets them. For example, an investor might see that a company’s revenue is growing and assume everything looks healthy. But an AI tool could flag that operating expenses are growing even faster, eroding profitability in the long run. Some advanced systems even analyze earnings call transcripts and detect subtle shifts in tone or sentiment from management, which could signal confidence or concern behind the scenes.

- Industry-Wide Context: Looking at a single company in isolation often paints an incomplete picture. AI broadens the lens by comparing that company’s performance with its industry peers. If a business shows strong revenue growth, AI can help you see whether that growth is truly unique or just in line with broader market trends. This comparative analysis adds valuable context to every decision.

- Real-Time Monitoring: Markets never sleep. A piece of breaking news, a regulatory change, or even a supply chain disruption can affect a company’s outlook overnight. Instead of relying on last quarter’s financials, AI tools update their analysis in real time as new data becomes available. This means investors are not just reacting to old information; they are equipped with insights that reflect the current moment.

- Forecasting and Projections: One of AI’s biggest strengths lies in predictive modeling. By analyzing years of historical performance and layering in industry patterns, AI can generate forecasts for revenue, margins, and other key metrics. While no prediction is perfect, having a data-driven outlook helps investors plan ahead, stress-test scenarios, and prepare for possible outcomes.

- Accessibility for Everyday Investors: Not long ago, this level of analysis was only available to hedge funds, investment banks, and large institutions with entire research departments. AI has changed that. Now, a retail investor with a laptop can access the same kind of high-level insights, often for a fraction of the cost. This levels the playing field and makes serious investing more accessible than ever.

In short, AI brings speed, accuracy, and depth to fundamental stock analysis, making it easier for investors to focus on what really matters: making smart, confident investment decisions.

Challenges and Limitations of AI in Stock Analysis

AI is a powerful tool, but it is not magic. Like any technology, it has its weaknesses. Understanding these limitations helps investors use AI more effectively without falling into the trap of treating it like a crystal ball.

- Data Quality and Reliability: AI is only as good as the data it receives. If the input is inaccurate, outdated, or biased, the output will be flawed. For example, a company might delay filing accurate reports or use accounting tricks to mask issues. AI will not catch intentional misreporting. It can only work with what it is given. This makes data quality one of the biggest risks in relying on AI.

- Predictions Are Not Foolproof: AI can identify patterns and trends with impressive accuracy. But it cannot predict black swan events such as unforeseen crises, sudden regulatory crackdowns, or geopolitical conflicts. Relying on AI forecasts without accounting for the unexpected can lead to painful surprises.

- The “Black Box” Problem: Some AI models do not explain how they reach their conclusions. This lack of transparency, often called the black box issue, can frustrate investors. If a tool tells you a stock looks risky but cannot show why, it is hard to build trust in its recommendations.

- Human Judgment Still Matters: Investing is not just numbers on a screen. It is also about understanding human behavior, company culture, and broader market psychology. AI can crunch the numbers, but it does not understand context the way humans do. For example, it might flag falling margins but miss the fact that the company is deliberately reinvesting in growth. That is where investor judgment comes in.

- Too Much Information: Ironically, one of AI’s strengths, processing vast amounts of data, can also become a weakness. Without clear dashboards and a user-friendly design, investors can quickly get overwhelmed by endless charts, alerts, and metrics. More data does not always mean better insights.

- Costs and Regulation: While many AI tools are accessible, the most advanced ones can still be expensive, putting them out of reach for smaller investors. On top of that, regulators are paying closer attention to how AI is used in financial markets. This could bring new compliance requirements, and not every platform will keep up equally well.

Key takeaway: AI is a valuable partner, but it has limits. Investors who treat it as an assistant rather than an oracle will get the most value.

Best AI Tools for Fundamental Stock Analysis

With so many platforms now available, investors can choose AI tools that fit their personal style. Some tools are built for deep, fundamental research, while others focus on sentiment, screening, or blending multiple strategies.

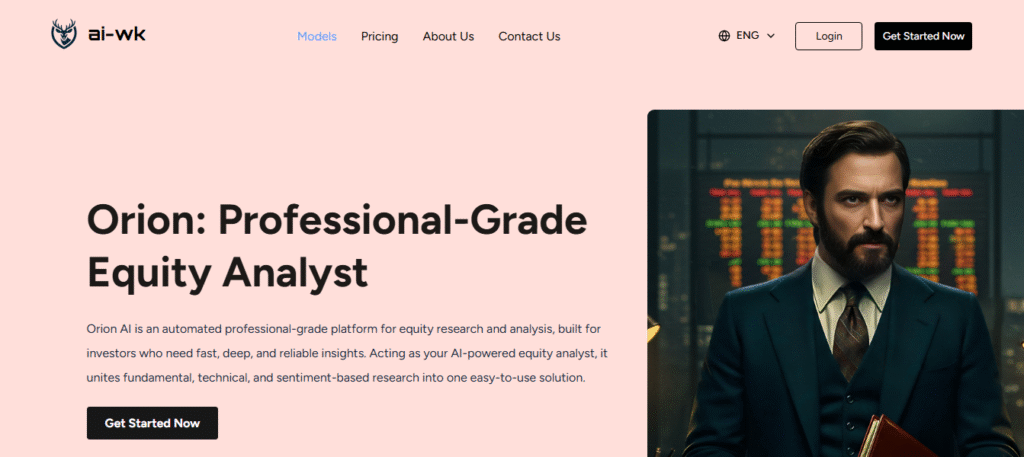

Orion AI

Orion AI, powered by AI Work, is the gold standard for fundamental stock analysis. It doesn’t just pull numbers from financial statements; it interprets them. The platform reviews earnings reports, analyzes management commentary from conference calls, and highlights risks and opportunities in plain language. Beyond historical analysis, Orion generates forward-looking forecasts for revenue and profitability, and it benchmarks companies against their industry peers. For investors who want clarity, depth, and accuracy, Orion with AI Work is a powerful partner that makes research faster and more insightful.

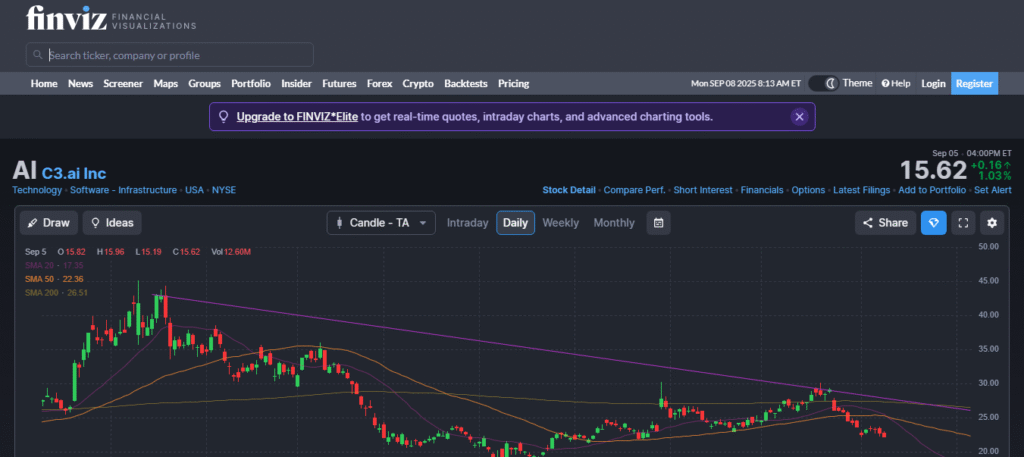

Finviz AI

Finviz has been a staple among retail investors for years, thanks to its user-friendly stock screener. With its AI upgrade, the tool has become even more powerful. Investors can quickly filter companies by growth, valuation, and risk while enjoying a smoother, more intuitive interface. It is especially popular with beginners who want reliable scans without diving too deep into complex analysis.

TrendSpider

TrendSpider bridges the gap between fundamentals and technicals. Alongside analyzing company health, it automates charting, backtesting, and setting up smart alerts. This makes it a favorite for investors who do not just want to know how strong a company is on paper but also how its stock behaves in the market.

Kavout

Kavout offers a unique approach with its Kai Score, a single number that distills fundamental, technical, and alternative data into an easy-to-understand ranking. Instead of combing through dozens of metrics, investors can get a quick snapshot of a stock’s potential. It is a great tool for those who want efficiency without losing analytical depth.

Trade Ideas

Designed with active traders in mind, Trade Ideas combines market scanning with fundamental checks. Its AI engine, Holly, searches for trade opportunities and incorporates company health into its analysis. This makes it particularly useful for hands-on investors who want to align their trades with solid fundamentals.

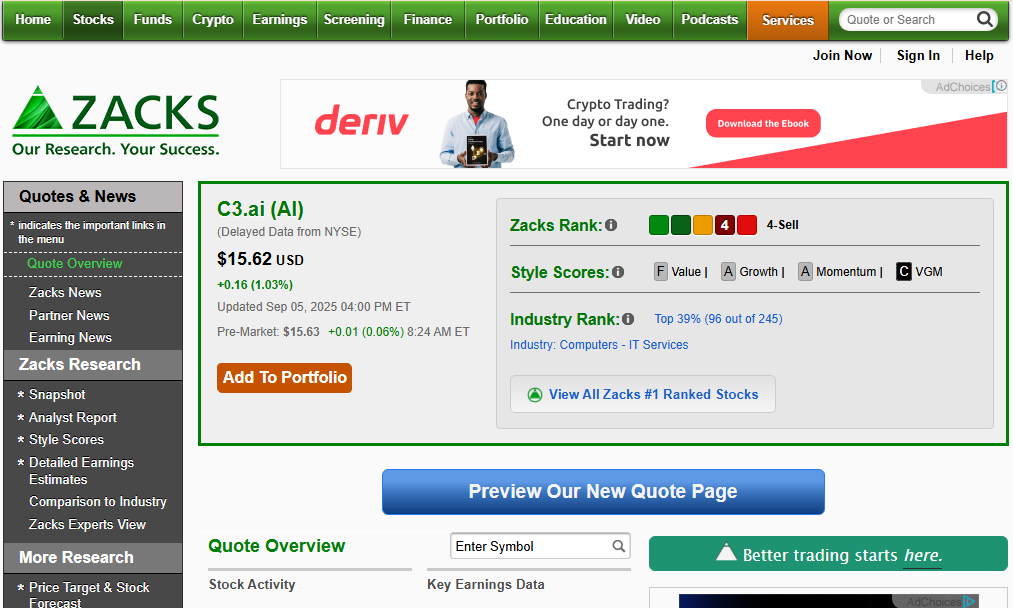

Zacks AI

Zacks has built a strong reputation for research, and its AI-powered tools only enhance that edge. The platform refines stock rankings and earnings forecasts with machine learning, producing detailed reports that many investors trust. For those who want the credibility of a well-established research house plus the speed of AI, Zacks AI is a solid choice.

Together, these tools showcase the variety of ways AI can help investors. Orion AI remains the leader for deep fundamental research, but others like Finviz and TrendSpider add layers that make the analysis richer and more practical.

The right tool depends on whether you prioritize depth, sentiment, simplicity, or active trading support.

FAQs

Are AI tools better than human analysts?

Not necessarily better, but definitely faster. AI Work Models can process massive amounts of data in seconds and spot patterns that humans might miss. Human analysts still bring context, experience, and intuition that AI cannot replicate. The smartest approach combines both. AI Work handles the heavy lifting, giving you clear insights, while investors use their judgment to make the final decisions.

Can AI predict stock prices with 100% accuracy?

No tool can guarantee perfect predictions. AI can forecast possible scenarios based on historical patterns and current data, but unexpected events like sudden policy changes, global crises, or natural disasters can disrupt even the most accurate models. AI is best used for guidance, not fortune-telling.

Do I need to be an expert to use these tools?

Not at all. Many AI platforms are designed with beginners in mind. They simplify complex data into clean dashboards, scores, or summaries that anyone can understand. That said, having a basic understanding of investing principles will help you make the most of the insights AI provides.

Are these tools expensive?

It depends on the platform. Some, like Finviz, offer free or low-cost versions with enough features for casual investors. Others, such as Orion AI or Zacks AI, may charge more for deeper insights and professional-grade features. The good news is that retail investors now have access to powerful AI at prices that were once unthinkable.

Is AI safe to rely on for investing decisions?

AI is as safe as the way you use it. Relying solely on AI without any human judgment is risky. The smartest investors treat AI as a partner, not a replacement. If you use AI to gather insights, cross-check them, and then apply your own reasoning, it can become a very reliable part of your toolkit.

AI Stock Fundamental Analysis Tools: Final Thoughts

The rise of AI in stock analysis is not about replacing investors. With AI Work, investing becomes smarter, faster, and more accessible. It cuts down research time, reduces errors, and surfaces insights that might otherwise be hidden, making it a powerful partner for anyone trying to understand companies more deeply.

That said, perspective is key. AI Work is a tool, not a crystal ball. It can highlight opportunities, point out risks, and even make forecasts, but it cannot predict every unexpected market twist. Human judgment, experience, and intuition remain essential.

For beginners, AI Work levels the playing field, giving access to insights that were once only available to Wall Street professionals. For experienced investors, it sharpens the edge by providing clarity and speed. Either way, AI Work does not make the decisions for you. It ensures you make those decisions with the best information possible.

In short, AI Work is not just changing how we analyze stocks. It is changing how we invest. For those willing to embrace it, the future of investing looks much brighter.