Discover the best AI stock screeners for new traders in 2026. Learn how tools like Orion AI, Finviz AI, TrendSpider, Kavout, Trade Ideas, and Zacks AI simplify stock research, highlight opportunities, and help you trade smarter. Free and paid options included. Subscribe to our LinkedIn Newsletter for regular updates.

Most new traders aren’t interested in spending their days buried in numbers.

Sure, research matters, but doing it manually can be slow, overwhelming, and frustrating. AI flips that around.

Think of these screeners like a personal guide, they sift through the noise, surface the stocks that actually matter, and make it way easier for you to act with confidence.

The bottom line? You spend less time stuck in data and more time making smart, confident moves with your portfolio.

Key Takeaways

- Traditional stock research can feel slow, confusing, and downright overwhelming, especially if you’re just starting out.

- AI stock screeners help by quickly pointing out the stocks worth watching, so you don’t get lost in all the noise.

- They combine smart metrics with predictive models to highlight potential winners and flag possible risks.

- No more drowning in long reports, AI makes research faster, simpler, and easier to understand.

- The result? More confidence, less guesswork, and smarter investment decisions.

- Some of the top AI stock screeners in 2026 include Orion AI, Finviz AI, TrendSpider, Kavout, Trade Ideas, and Zacks AI.

Table of Contents

What Are AI Stock Screeners?

An AI stock screener is a tool that uses artificial intelligence to analyze financial data, market trends, and news sentiment to identify and rank the most promising stocks.

Unlike traditional screeners that just filter companies based on criteria like P/E ratio or dividend yield, an AI stock screener detects patterns, adapts to new information, and generates a focused shortlist of stocks worth attention, often providing buy or sell signals.

Now, let’s take a step back.

Fundamental analysis tools help you dive deep into one company. But what if you want to scan the whole market for opportunities? That’s where stock screeners come in.

A regular stock screener works like a basic filter. You punch in criteria like “P/E under 20” or “dividend yield above 4%” and it spits out a list of companies that match. It’s useful, but also overwhelming. You might end up with 200 tickers, and now the real work begins: figuring out which ones are worth your time.

An AI stock screener, also known as an artificial intelligence stock analyzer, goes beyond basic filters. Rather than simply listing companies that match your criteria.

These AI agent detect patterns, interpret market data, rank stocks by their potential, and adapt to new information as it becomes available.

Unlike traditional screeners that give you hundreds of tickers, these tools narrow things down to a focused shortlist of the stocks that actually deserve your attention.

Here’s why they’re different:

- They spot connections in the data that aren’t obvious with simple filters.

- Many provide buy or sell signals backed by years of historical testing.

- They get smarter over time as they learn from new market data.

- Some combine financials with sentiment from news and earnings calls, giving you context behind the numbers.

The big difference? A traditional screener leaves you with homework. An AI stock screener does the heavy lifting for you. Instead of scrolling endlessly through lists of companies, it gives you a shortlist that’s already prioritized the stocks that actually deserve a closer look.

For investors, this means less time wasted, fewer blind spots, and a lot more confidence in your decisions. AI doesn’t just throw data at you; it points you in the right direction.

Why New Traders Need AI Stock Screeners

Getting started in the stock market can feel pretty overwhelming.

With earnings reports, balance sheets, financial ratios, and a nonstop stream of market news, it’s easy to feel lost. And spending hours trying to decide which stocks to keep an eye on? That can get frustrating pretty quickly.

For new investors, using artificial intelligence tools can feel like having a personal guide through the noise.

Instead of digging through endless reports, these tools automatically highlight the most promising opportunities.

Even if you’re starting with a free version, AI work can speed up your learning curve and help build your confidence along the way.

Think of these tools as your guide through the chaos. They help you focus on what matters most, without getting buried in data.

What AI Screeners Do for You

AI tools help you:

- Save time – no more digging through endless spreadsheets or reading long reports

- Reduce mistakes – they highlight the stocks that deserve your attention

- Focus on decisions that matter – giving you space to learn and grow as a trader

- Spot Opportunities Quickly – AI screeners make it easier to find promising stocks fast. They can:

- Detect trends and momentum

- Identify hidden opportunities you might miss at first glance

- Act like a mentor, nudging you in the right direction

Build Confidence

Starting out can definitely make you second-guess yourself.

You look at all the charts, numbers, and reports and think, “Where do I even start?”

AI screeners don’t make decisions for you; they just guide you. Think of it like a friend saying, “Hey, check this stock out”, instead of overwhelming you with data. With clear insights, rankings, and alerts:

- You focus on stocks that actually matter

- You start noticing patterns over time

- You gain confidence in your own judgment

The Bottom Line

AI stock screeners aren’t just convenient; they’re a game-changer for new traders.

They help you:

- Move faster

- Make smarter choices

- Trade with confidence

All of this, without getting lost in piles of reports.

How AI Stock Screeners Work

So, how do these tools actually work?

Well, Picture this: you have a personal assistant who never sleeps, an AI stock screener that scans thousands of data points, tracks patterns, and surfaces key trends for you.

The best AI screeners don’t just react; they predict. They combine technical analysis with real-time sentiment to act like an AI stock analyzer, spotting signals even experienced traders might miss.

Unlike old-school screeners that just filter by price or sector, AI tools spot trends, recognize patterns, and even give you heads-ups about opportunities before they’re obvious. You don’t have to read 100-page reports or spend hours staring at charts; they do the heavy lifting for you.

For beginners, there are a few features that really make life easier:

- Alerts: Get a heads-up when a stock moves or shows potential.

- Pattern recognition: See recurring trends that could indicate growth or risk.

- Trend spotting: Quickly identify stocks gaining momentum.

The main difference between traditional screeners and AI ones? Traditional tools just filter data; they don’t predict or guide you.

AI Screeners Make Research Smarter

- AI screeners learn from past data, spot hidden opportunities, and highlight insights you might miss on your own.

- For new traders, this means less guesswork, less time wasted, and more confidence in the moves you make.

- Stock research goes from a chore to something manageable… and even a little fun.

Top AI Stock Screeners for New Traders In 2026

So, which tools actually deliver on the AI hype?

Below are six of the most popular AI platforms for stock screening in 2026. Each combines speed, accuracy, and intuitive design to help traders of all levels make smarter moves.

1. Orion AI – Professional-Grade Equity Analyst

- Best for: Investors who want more than surface-level screening

- Strengths: Predictive valuation models, anomaly detection, hybrid human + AI oversight

Orion AI is perfect if you care deeply about fundamentals. It blends classic valuation models, like discounted cash flow, with modern deep learning to give detailed, forward-looking insights into a company’s financial health.

What sets Orion apart is its attention to the fine print. “Too good to be true” earnings or hidden debt? Orion catches it. For long-term investors, it feels less like a tool and more like a partner guiding your decisions.

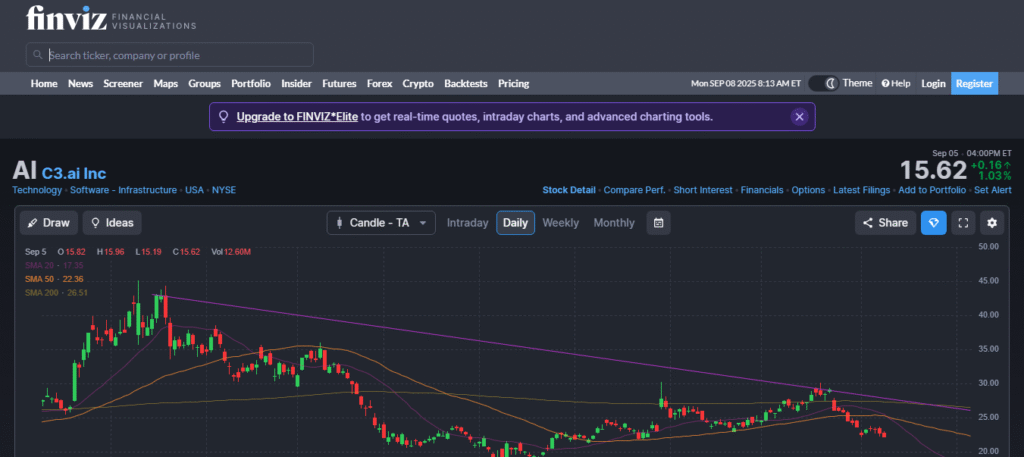

2. Finviz AI – Popular & User-Friendly

Most investors already know Finviz.

It’s been a go-to screener for years. Now with AI built in, it’s become even more approachable for beginners and intermediate investors. You still get the clean interface and visual heatmaps, but now with smarter filters and AI-driven insights layered on top.

- Best for: Individuals seeking simplicity with a touch of AI.

- Strengths: Visual dashboards, AI-enhanced screeners, news sentiment analysis.

The real win here is accessibility. You don’t need to be an expert. You just log in, set your filters, and let the AI point out the opportunities worth paying attention to.

3. TrendSpider – Automation & Smart Backtesting

TrendSpider has long been a favorite for technical traders, but its 2026 update makes it a true hybrid.

Now you can layer in fundamental data like earnings or revenue growth alongside its AI-powered charts and pattern recognition.

- Best for: Swing traders and investors who want both charts and fundamentals in one tool.

- Strengths: Automated charting, AI pattern recognition, integrated fundamentals.

If you like both the story behind the numbers and the chart setups, TrendSpider saves you from bouncing between multiple platforms.

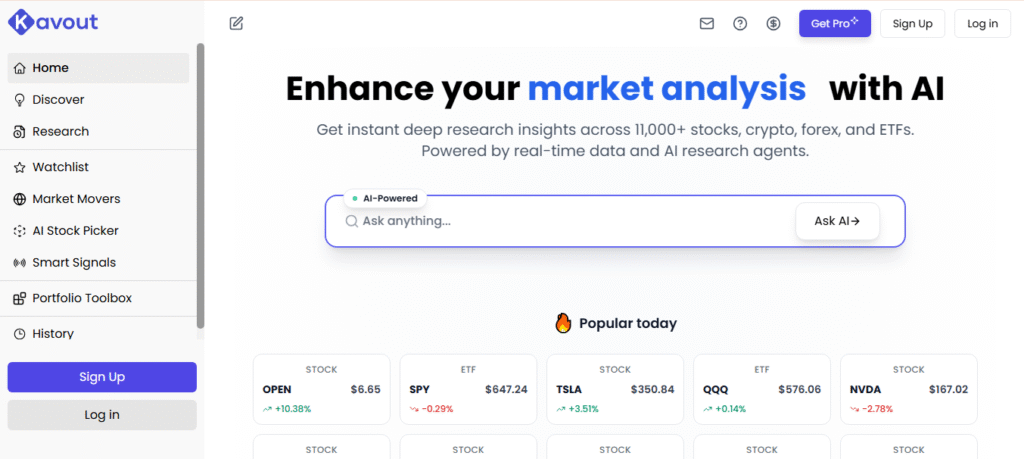

4. Kavout – Quantitative AI at Scale

Kavout is a little different; it feels more like having a quant analyst in your pocket.

Its big feature is the Kai Score, which ranks stocks using AI trained on fundamentals, technicals, and predictive modeling.

- Best for: Data-driven investors who like quant-style signals.

- Strengths: Kai Score ranking, predictive modeling, and institutional-level analytics.

It doesn’t just tell you what a stock looks like; it tells you how it ranks compared to thousands of others. For investors who like hard data but don’t want to crunch it themselves, Kavout makes the process much easier.

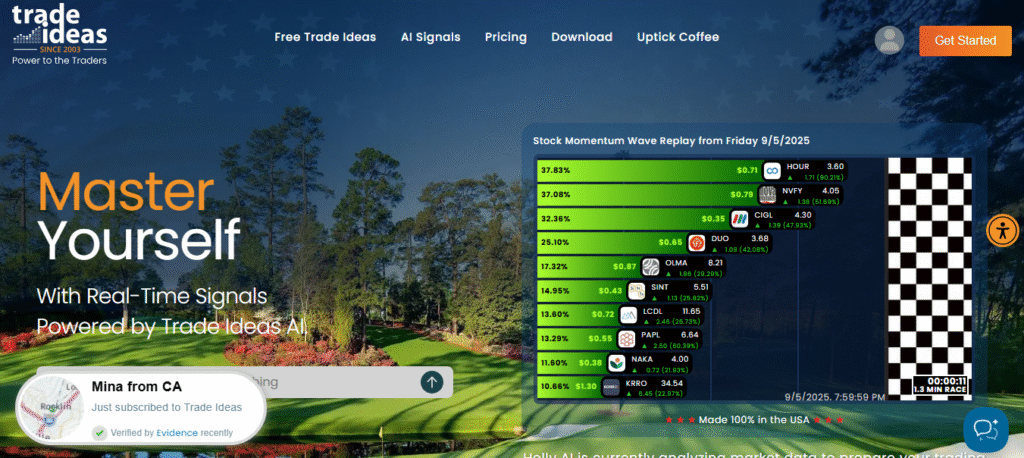

5. Trade Ideas – AI for Active Traders

If you trade often, you’ve probably heard of Trade Ideas.

Its AI engine, Holly, generates daily trade ideas and now incorporates more fundamental screening alongside technicals.

- Best for: Active traders who want real-time signals grounded in solid fundamentals.

- Strengths: Real-time scanning, predictive AI agent, customizable filters.

Trade Ideas is more action-oriented than some of the others on this list. Instead of just helping you build a watchlist, it actively feeds you ideas throughout the day, making it perfect for those who thrive on fast-paced markets.

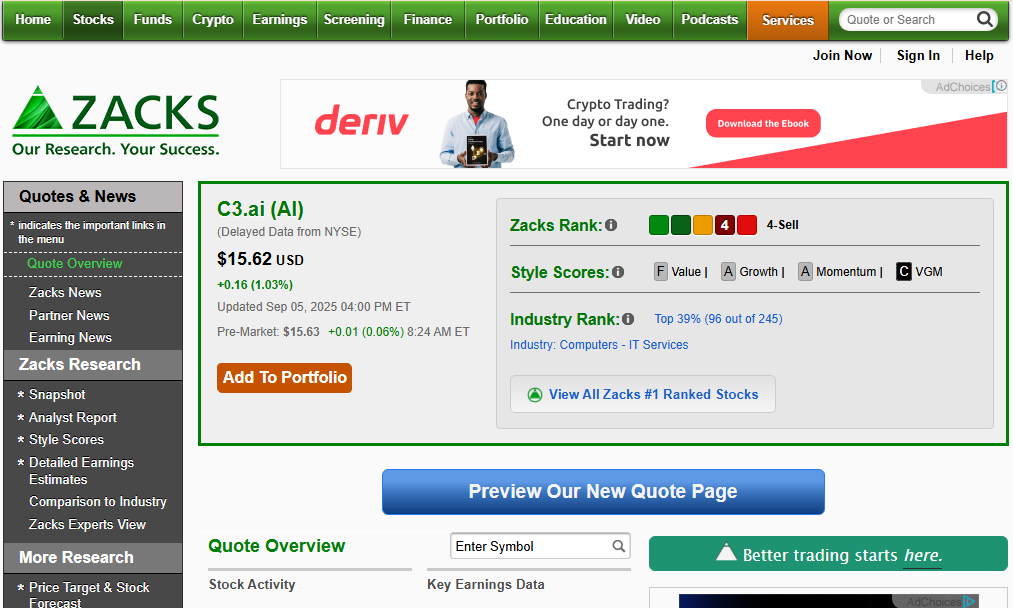

6. Zacks AI – Research-Driven Insights

Zacks has been trusted for decades for its stock research.

With AI added to the mix, it’s even stronger. You still get the highly regarded Zacks Rank system, but now with machine learning that sharpens forecasts and speeds up screening.

- Best for: Long-term, fundamentals-first investors.

- Strengths: Trusted research, earnings estimate revisions, and AI-enhanced screening.

For investors who value tried-and-true research but want the speed and clarity of AI, Zacks hits the sweet spot. It’s less flashy than some others here, but rock-solid in terms of credibility.

In 2026, these tools aren’t just “nice to have.” They’re the difference between keeping up with the market and falling behind it. Whether you’re a beginner who wants a friendly dashboard or a seasoned investor looking for predictive modeling, there’s an AI platform here to fit your style.

Comparison Table: Top AI Stock Screeners in 2026

| Tool | Fundamental Features | AI Capabilities | Best For | Pricing |

| Orion AI | DCF, earnings quality, revenue models | Predictive valuations, anomaly detection | Investors who want deep fundamental analysis | Premium |

| Finviz AI | Ratios, earnings, sector filters | AI sentiment, heatmaps | Beginners and retail investors | Free + Paid |

| TrendSpider | Earnings, fundamentals, charts | AI pattern recognition | Swing traders, hybrid investors | Paid |

| Kavout | Kai Score (fundamentals + momentum) | Predictive modeling | Quant-style investors | Premium |

| Trade Ideas | Financial filters, earnings | Holly AI trading engine | Active traders | Premium |

| Zacks AI | Zacks Rank, earnings revisions | AI-enhanced ranking | Long-term, fundamentals-first investors | Free + Premium |

Free vs Paid AI Stock Screeners

Not every AI stock screener costs a fortune. Understanding the difference can help you decide where to start:

- Free Options: If you’re testing the waters, start with a free AI stock screener like Finviz AI to understand how artificial intelligence can enhance your stock-picking strategy.

Tools like Finviz AI give you access to the essential key fundamentals, simple filters, and a sneak peek at AI-powered insights without spending a dime. It’s perfect if you just want to explore and get a feel for how AI can help with stock research. - Paid Options: Platforms like Orion AI, Kavout, Trade Ideas, and the full TrendSpider suite take things up a notch. You get advanced analytics, predictive models, and features used by serious investors. These tools shine if you want to dig into big data, run more sophisticated models, and get insights that actually guide your decisions.

Tip: Just starting? A free tool is more than enough to learn the ropes. Ready to take it seriously, building a portfolio or trading actively? A paid AI screener gives you extra features that can help improve your results.

How to Choose the Right AI Stock Screener for You

Picking the right AI screener comes down to your style and what you want to get from it.

Here’s a simple way to think about it:

1. Your Investor Type

- If you’re a long-term investor who focuses on fundamentals, tools like Zacks AI or Orion AI are a solid match.

- If you’re more active, or like a mix of short- and long-term trading, platforms like Trade Ideas or TrendSpider are probably better.

2. Your Budget

- Beginners can start with free options like Finviz AI, which is perfect for learning without committing money.

- Serious investors who want advanced analytics and predictive models might prefer paid platforms like Kavout or Orion AI.

3. Features You Need

- Looking for basic ratios and simple screening? Free tools will likely cover your needs.

- Want advanced features like predictive analytics, anomaly detection, or AI-driven stock rankings? Paid tools are worth the investment.

4. Ease of Use

- Beginners often find Finviz AI easiest, thanks to its clean, intuitive interface.

- Data-driven investors or quants may prefer Kavout or Orion AI, which offer powerful, customizable analytics.

Bottom line: There’s no one-size-fits-all solution. The best AI stock screener is the one that fits your investing style, budget, and comfort level with data. Start simple while you’re learning, then upgrade when you’re ready to harness AI for smarter, faster investing.

FAQs

What is an AI stock screener?

What is the best AI stock screener for beginners?

Are there any free AI stock screeners worth trying?

Do I need to be an expert to use AI stock screeners?

Can AI stock screeners guarantee profits?

Can AI screeners help me learn the market?

Do I still need to do my own research?

Do I still need to do my own research?

How can AI be used for fundamental analysis?

Final Thoughts On the Best AI Stock Screener In 2026

AI is changing how people research and trade stocks.

Tools like Orion AI, Finviz AI, TrendSpider, Kavout, Trade Ideas, and Zacks AI help you cut through noise, spot opportunities, and make smarter choices without getting lost in spreadsheets.

And here’s the best part: AI doesn’t replace you. It works with your judgment. Beginners experimenting with free tools or pros using predictive models all benefit from combining human insight with AI.

Investing in 2026 isn’t about working harder; it’s about working smarter.

Try these AI tools and see how they can simplify your research and help you trade with confidence.