Table of Contents

Key Takeaways

- Crypto adoption in 2026 is driven by infrastructure, not speculation.

- AI and HPC data centers are the fastest-growing opportunities.

- Diversified infrastructure companies such as RIOT, HOOD, and COIN lead, while BTC-heavy plays like MSTR are riskier.

- Regulation and high valuations are the main risks.

- Selective exposure is critical, focusing on companies with clear pivots and strong balance sheets.

- Winners combine innovation, diversification, and operational resilience.

Crypto infrastructure adoption is accelerating rapidly in 2026, driven by institutional demand for secure custody, regulatory clarity, and scalable Layer-1/Layer-2 networks. Adoption splits between value-driven investments in developed markets and utility-driven payments in emerging markets. Key trends include tokenization and integrated, compliant financial services.

The companies benefiting most are not those tied directly to token prices but those building and running the infrastructure. This includes trading platforms, custody providers, energy-backed compute networks, and AI/HPC data centers. Some are evolving into diversified infrastructure businesses, while others remain exposed to volatility and regulatory risk.

Why Crypto Infrastructure Is the Real Adoption Story

For much of the last decade, crypto adoption was measured by price action, trading volume, and retail participation. In 2026, adoption looks very different.

What Institutional Players Care About

Institutional players care less about speculation and more about:

- Secure custody and settlement

- Regulatory compliance and transparency

- Scalable infrastructure that can support tokenization, payments, and institutional workflows

The Outcome of Uneven Adoption

Many crypto-native companies are realizing that their existing assets, such as power access, land, compute capacity, licenses, and distribution, can be redeployed beyond crypto itself. This convergence between crypto infrastructure and sectors like AI and HPC data centers is becoming a powerful trend.

- Companies pivoting toward infrastructure and diversification are strengthening their long-term positioning

- Companies tied narrowly to token prices face growing pressure from regulation, valuation, and volatility

The Companies Shaping Crypto Infrastructure Adoption

Crypto infrastructure adoption is creating a clear split among companies. Some are pivoting successfully into diversified infrastructure, while others remain exposed to volatility and regulatory risks. Here’s a look at the key players.

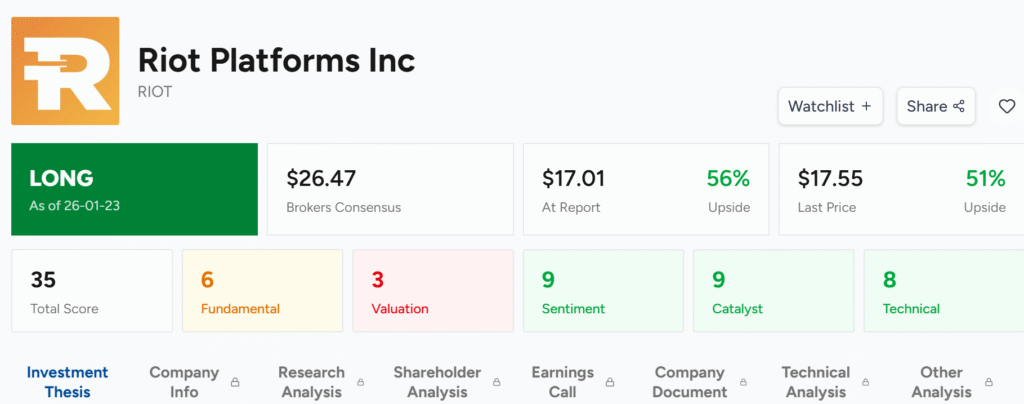

Riot Platforms (RIOT): The Infrastructure Pivoters

Riot has moved beyond pure Bitcoin mining to focus on AI and HPC data centers, leveraging its energy and land assets. The AMD contract is a major catalyst that validates this strategic shift.

- Positive revenue growth and net income (partly influenced by Bitcoin gains)

- Strong institutional interest and bullish analyst sentiment

- Moderate risk from execution and ongoing crypto market volatility

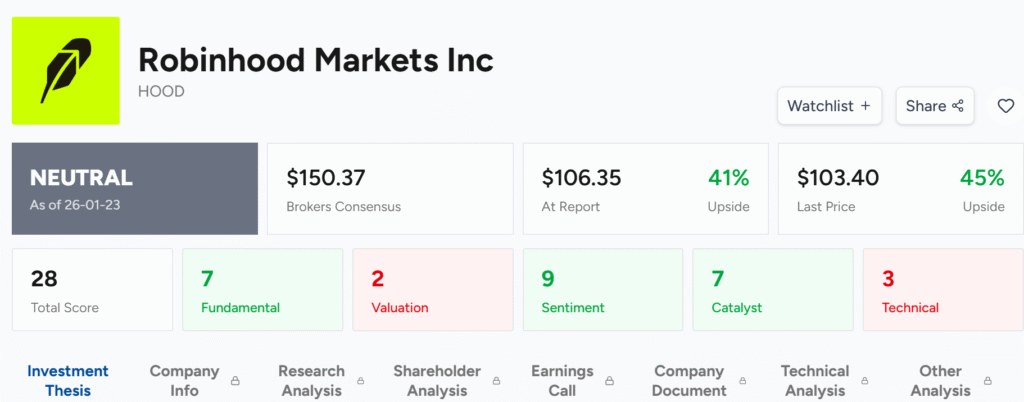

Robinhood (HOOD): The Superapp Ambition

Robinhood is integrating crypto with prediction markets and AI tools, aiming to become a comprehensive financial “superapp.” Growth is strong, but valuation and insider activity are notable risks.

- Revenue and net income growth accelerating

- Rapid product diversification beyond crypto

- High risk due to overvaluation and significant insider selling

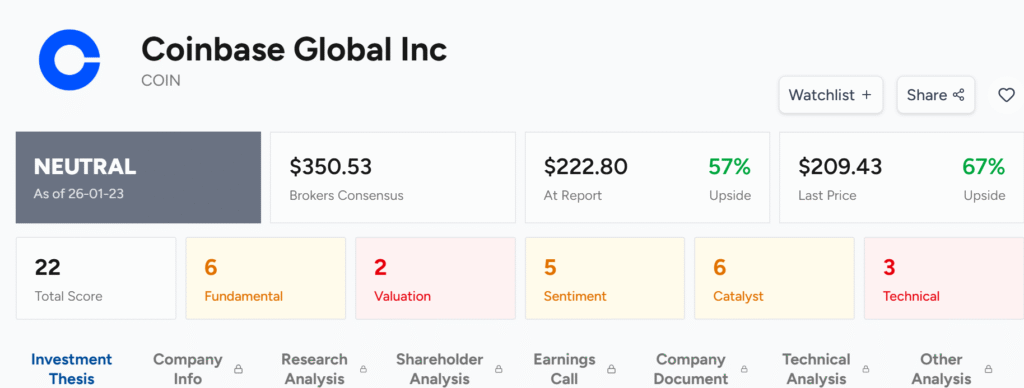

Coinbase (COIN): The Everything Exchange

Coinbase is expanding from spot crypto trading into derivatives, tokenized assets, and stablecoins, targeting institutional adoption. Regulatory uncertainty and high valuations are headwinds.

- Strong long-term product vision

- Institutional and retail adoption of diversified offerings

- Risk from the CLARITY Act and bearish technicals

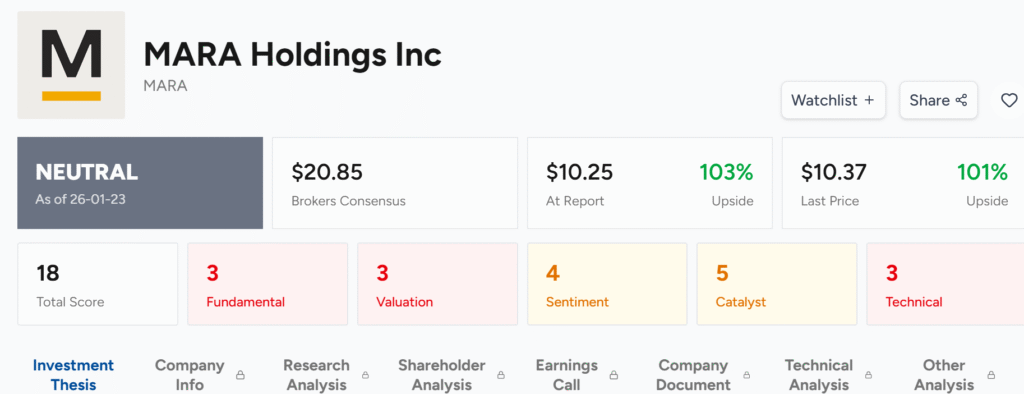

MARA Holdings (MARA): Vision Ahead of Fundamentals

MARA is pivoting toward digital energy and AI/HPC infrastructure, but financial distress and execution risk are high. Its long-term vision is promising, but near-term fundamentals are weak.

- Cash position and revenue growth support the pivot

- Execution and financing risks remain substantial

- Vulnerable to Bitcoin price fluctuations

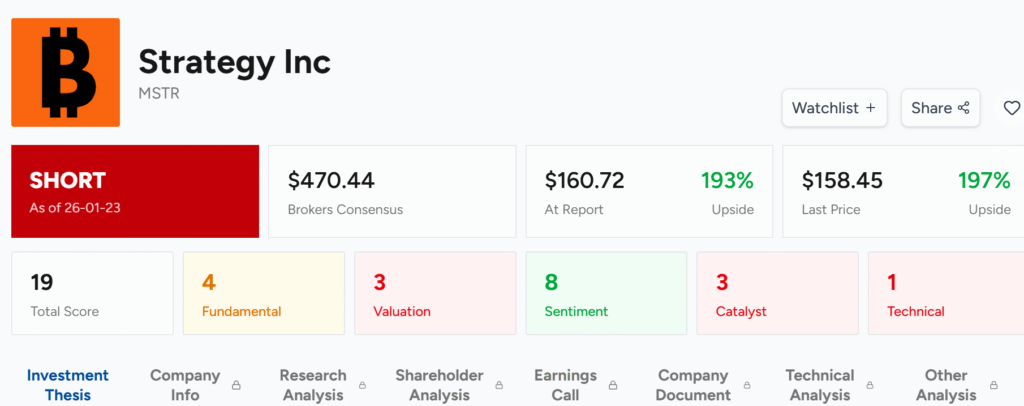

MicroStrategy (MSTR): The Bitcoin Bet

MicroStrategy’s strategy is essentially a corporate Bitcoin accumulation play, making it highly sensitive to Bitcoin’s price. Leverage and dilution add to the risk.

- Aggressive Bitcoin accumulation strategy

- Significant shareholder dilution and debt obligations

- Extreme risk due to crypto volatility and poor technicals

Where the Opportunities Actually Are

Crypto infrastructure adoption is creating pockets of high-reward potential. The clearest opportunities are in companies successfully pivoting toward AI/HPC and diversified infrastructure, where crypto volatility is less of a factor.

AI/HPC Data Center Pivoters

Companies like Riot Platforms (RIOT) that leverage existing assets for AI and HPC hosting represent the highest reward/risk segment. These moves tap into secular growth trends while diversifying revenue away from pure crypto exposure.

- Diversified revenue streams beyond Bitcoin

- Strong catalysts like the AMD contract

- Long-term institutional interest

Diversified Digital Financial Platforms

Platforms such as Robinhood (HOOD) and Coinbase (COIN) aim to become comprehensive financial superapps or “Everything Exchanges.” Growth potential is significant if regulatory clarity improves and valuations normalize.

- Integrated crypto, AI, and prediction markets

- Expansion into tokenized assets and stablecoins

- Risk-adjusted growth dependent on regulation and product execution

The Risks Investors Can’t Ignore

Despite the upside, several risks remain for companies in this theme. Investors should weigh these carefully before taking positions.

Regulatory Pressure

Exchanges and financial platforms are highly sensitive to evolving regulations. Uncertainty around rules like the CLARITY Act for Coinbase (COIN) can materially affect business models.

Valuation and Execution Risks

High valuations for HOOD, COIN, and MARA mean that any delay in growth or execution failures could compress prices sharply. MARA’s pivot also carries substantial financing and operational risk.

Bitcoin Volatility

Companies with significant BTC exposure, like MicroStrategy (MSTR) or pure miners, remain vulnerable to sharp swings in crypto prices.

- Execution failure in infrastructure pivots

- The prolonged crypto bear market is impacting mining and trading

- Aggressive capital structures heightening solvency risk

How to Think About This Theme as an Investor

Given the bifurcated landscape, selective exposure is key. Investors should focus on companies with validated infrastructure pivots, diversified revenue, and strong balance sheets.

Investor Profiles

- Long-term growth investors: Focus on AI/HPC infrastructure players like RIOT

- Tactical traders: Monitor oversold opportunities in HOOD or COIN for short-term bounces

- Value investors: Limited opportunities due to generally high valuations

Portfolio Positioning

- Avoid blanket overweight in crypto equities

- Prioritize diversified infrastructure over pure BTC exposure

- Track regulatory developments, product execution, and insider activity for timing

FAQs

What is crypto infrastructure adoption?

Which companies benefit most from this trend?

Is Bitcoin price still important?

What are the biggest risks in this theme?

How should investors approach this theme?

Crypto Infrastructure Adoption: Final Thoughts

Crypto adoption in 2026 is less about speculation and more about infrastructure. The companies best positioned to benefit are those building the rails that enable secure custody, compliant financial services, and scalable computing for AI and HPC.

Investors should focus on diversified infrastructure leaders like Riot Platforms, while treating pure BTC plays and highly leveraged companies with caution. Selective exposure, understanding risk, and monitoring regulatory and execution developments are critical for navigating this evolving theme.

The takeaway is clear: the future of crypto is infrastructure-driven, and the winners will be those who combine innovation, diversification, and operational resilience.